- Who We Help

Learn about our innovative AI products and Lead-to-Loan™ solutions for both Auto and Installment Lenders

Auto LendersIt’s not simply just the borrower risk—it’s about the vehicle, the deal structure, and the effectiveness of your collections process/skip-tracing

Installment and Single Repayment LendersOptimize loan originations and workflows with our suite of Installment & Single Repayment Lending solutions

Property Managers & LandlordsSeamless tenant screening solutions ensure secure income verification, strengthen fraud prevention efforts, and provide valuable financial insights

- Solutions

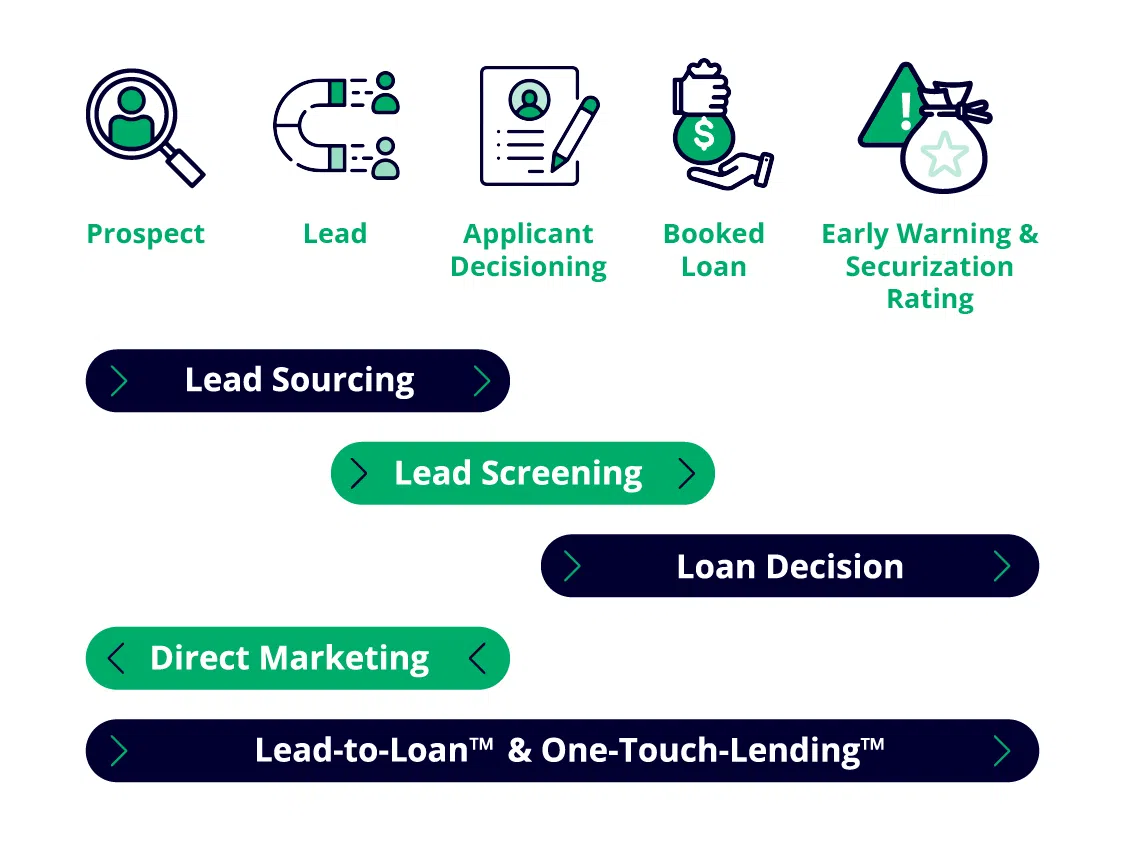

Integrated and Optimized solutions, providing support at any end every step—from Lead-to-Loan™

The underlying technology and intellectual property that support Trust Science products

Borrower LifecycleRevamp and optimize lending processes, from Lead to Loan™

Lead GenerationProven tools that align risk and marketing to find the best leads for lenders

Credit AdjudicationUtilizing both standard and unconventional data, Explainable AI/ML Decisioning enhances credit assessment and lending efficiency

Rating Agency 2.0™Get under the cover of a book of loans

- Products

Industry leading products that improve lender efficiencies, reduce defaults, and increase originationsTechnologyThe underlying technology and intellectual property that support Trust Science products

Six°Score™Stop overlooking creditworthy borrowers with our flagship AI & ML scoring model

Fl°wBuilder™Automate tasks from lead screening to approvals using Fl°wbuilder™, the virtual decision engine

Direct MarketingOptimize direct marketing with our configurable tools

BankingLeverage safe, secure and consented banking insights and verification through Smart Consent™

Lead Sourcing and Screening"Helping Lenders Find Great Borrowers™" Solution for improved conversions, larger deals, and reduced costs

- Resources

Learn more about what we do and what we’re working onBlog

Short reads and insights into AI, FinTech, and the Economy

Gartner® Research MentionsLearn about the research mentions that highlight Trust Science as gold standards for the industry

EventsEvents we have previously attended and will be at in the future

Media KitMaterial geared towards media professionals

ArticlesTrust Science in the media

- About Us

Get to know our passionate team, find exciting career opportunities, and learn about our cutting-edge security standards

Our TeamThe experts behind our product

Press ReleasesThe most important announcements, all in one place

PartnersExplore our array of partnerships, integrations and industry partners

TrustOur world-class security, privacy and governance standards

CareersJoin Trust Science: Why & How

Invisible Primes™Learn more about the customers our models seek to uncover

- Support

- Support

SupportClient support

Consumer DisclosureFor consumers, inquire/dispute your Consumer Disclosure

Consumer ResourcesResources and references for consumers

- Contact Us