Articles

Trust Science is committed to moving the credit industry forward through the use of alternative data, and automated machine learning underwriting. Take a look at our press coverage below.

Want to stay up to date with Trust Science news? Leave your name and email!

Why auto finance is lagging in digital sphere

"The newest study from J.D. Power showed how auto finance companies are struggling in the digital space compared to their contemporaries in other industries.

J.D. Power explained that auto finance companies need to do everything they can to deliver stand-out customer experiences while reducing administrative costs against a backdrop of shrinking margins and strained profitability.

"

Continue Reading

Trust Science Leverages Latest Tech to Help Lenders Better Assess Borrowers

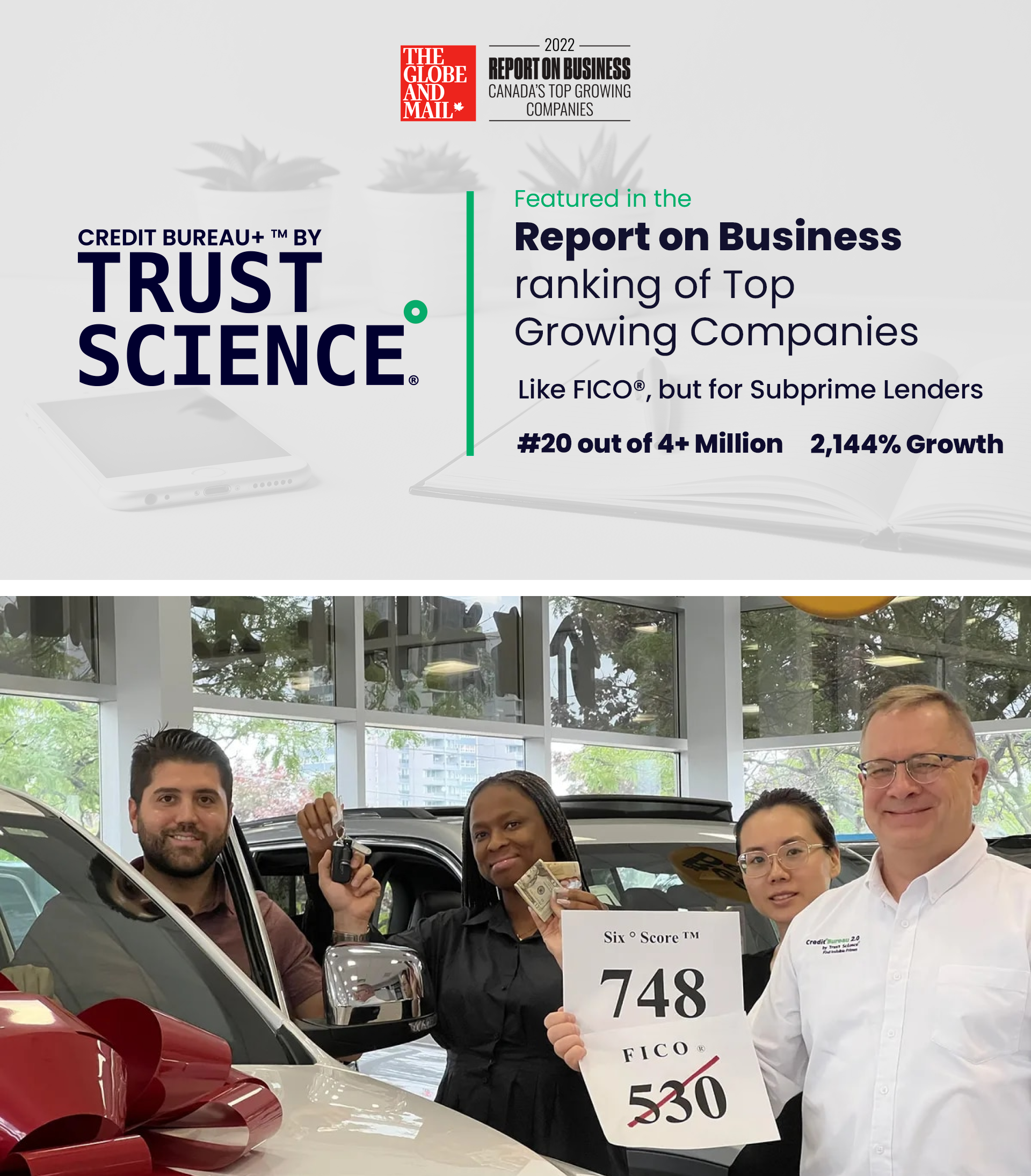

"An Edmonton-based financial technology upstart is among Canada’s fastest-growing companies, according to an annual ranking from The Globe & Mail.

Founder Evan Chrapko launched Trust Science with a target toward what he calls “Invisible Primes”—the 90 million credit-invisible people living in North America who are left “outside of the modern economy."

Continue Reading

Conventional Credit Bureaus Are Broken: How AI, ML and Alternative Data Are Fixing the Credit Catch-22

"Roughly 1 in 5 adults in the US and Canada lack an accurate conventional credit score, disproportionately impacting underbanked, new to credit, and new to country consumers. Through a global pandemic, economic volatility, and substantial shifts in our way of living, the once-trusty credit scores and bureaus the financial services industry relies on today have been proven to become inaccurate and exclusionary, causing measurable pain for millions of consumers daily and leaving them on the outside of the modern economy."

Continue Reading

Strategy Upshift: It’s time to rethink the FICO score

"Since being introduced in 1956 by engineer Bill Fair and mathematician Earl Isaac, the Fair Isaac Corporation’s (FICO) scoring algorithms have been used to help predict a consumer’s financial behavior. However, a FICO score alone rarely tells the whole story, creating challenges for thin or no-file consumers to obtain credit, including auto loans.... Today’s artificial intelligence systems can provide consumer insights beyond FICO scores, especially in a marketplace where the largest segment of today’s consumers are avoiding credit cards altogether. "

*Auto Finance News Subscription Required*

Continue Reading

95 companies transforming the Canadian fintech landscape

From alternative lending to homeownership-as-a-service, fintech services in Canada have flourished in recent years. In this Market Map, we highlight the Canada-based companies reshaping financial services. Canada hasn’t escaped unscathed from the global pullback in fintech funding, but there are still plenty of companies in the country working to disrupt financial services. Canada-based fintech startups — several of which have...

Continue Reading

The Thoughtful Entrepreneur: Assessing Trust with Trust Science’s Evan Chrapko

"Trust Science aid preexisting data scientists or risk departments in assessing borrowers’ profiles. They can be the entire solution for smaller businesses or those who have never had experience working with a bureau before because of low score levels. They bring automation and automated decision-making in a high degree of predictability on creditworthiness."

Continue Reading

School For Startups Radio: Evan Chrapko is a serial entrepreneur and investor having served as CEO or advisor for numerous innovative start-ups including

"The problem with the current credit bureau system is that it does a really poor job of scoring the bottom half of the population, so a lot of financial exclusion and structural inequities exist." Evan Chrapko is a serial entrepreneur and investor having served as CEO or advisor for numerous innovative start-ups including....

Continue Reading

Startup Sales Strategy: How To Sell Your Technology Product With Evan Chrapko

Businesses need to think about who they can trust when making decisions in their businesses. It's difficult for entrepreneurs, but there are tools out now that will help them make better choices and avoid mistakes! For example- did you know an AI has been built which predicts human behavior around lending money?

Tune in as we discuss how tech startups can break through in the business!

Continue Reading

How Trust Science’s credit reporting technology helps serve the underbanked

After years of in-depth development of a highly complex and powerful platform, credit reporting agency Trust Science is taking off – and lifting untold millions out of sub-prime lending status along the way...

Continue Reading

Credit scores are broken. Fixing them is an alluring but elusive opportunity.

Credit scoring doesn’t work well for a lot of people. Those with low incomes, people of color and immigrants have been historically sidelined by the current system. Some of the nation’s most successful struggle with low credit scores despite their wealth. And if your fortune comes from crypto, you might as well be invisible to the current system.

Continue Reading

How To Lend Money To Strangers: Explainable AI and a new style of credit bureau, with Evan Chrapko

We eat volatility for breakfast, we make love to volatility! Which is handy, because we’ve all heard it, and, well, most of us have probably all said it, the world is very volatile at the moment. So when Evan Chrapko of Trust Science told me how their models embrace volatility, I knew we were onto something interesting. Even more so, because I spent a decade working in the credit bureaus myself, and that’s the industry that Trust Science is disrupting right now with its volatility-eating models.

Continue Reading

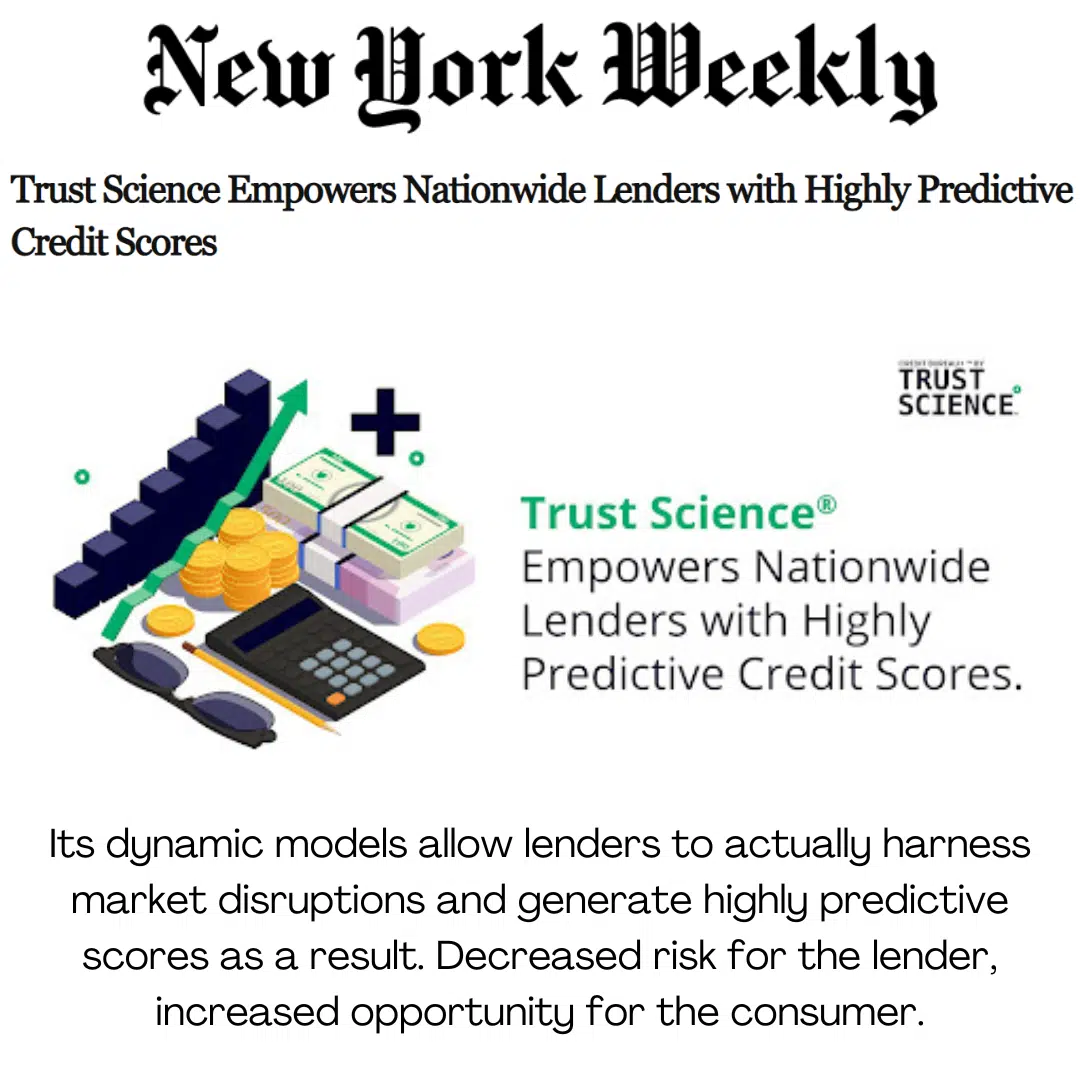

New York Weekly: Trust Science Empowers Nationwide Lenders with Highly Predictive Credit Scores

The events of the past two years have led to considerable financial upheaval, but recent economic data suggests that consumers have, for the most part, weathered the storm. While government responses to the pandemic – including stimulus checks and eviction moratoriums – helped during mandatory shutdowns, they also created an unexpected problem for consumers now trying to secure financing.

Continue Reading

US Times Now: Trust Science® on The Importance of Financial Inclusivity in 2022 and ADMS

2022 has marked the exit out of the COVID-19 pandemic, and with it, a major shift to the credit industry. While conventional credit has been blinded due to government policies and stimulus checks, lenders are demanding more predictive insights for everyone. Trust Science® is a fintech company that offers its Credit Bureau+™ SaaS to lenders, helping individuals get the credit they deserve making lending more ethical and fair.

Continue Reading

Disrupt: Trust Science® on Increasing Financial Inclusivity In Black Communities

Trust Science® is here to offer lenders a reliable and inclusive way of assessment that helps individuals get the credit they deserve, increasing financial inclusivity by making lending more ethical and fair. Their mission is to get deserving people access to the credit they deserve and help people who can’t get credit and are under-banked.

Continue Reading

NEXUS Miami: Trust Science Welcomes TD Bank's Imran Khan as Advisor

AI/ML-powered credit scoring company Trust Science announced the addition of Imran Khan, Global Head of Innovation at TD Bank, to the Advisory Board. Khan, an 11-year veteran of TD, joins a growing team of fintech expert advisors as founder and CEO Evan Chrapko scales his operation.

Continue Reading

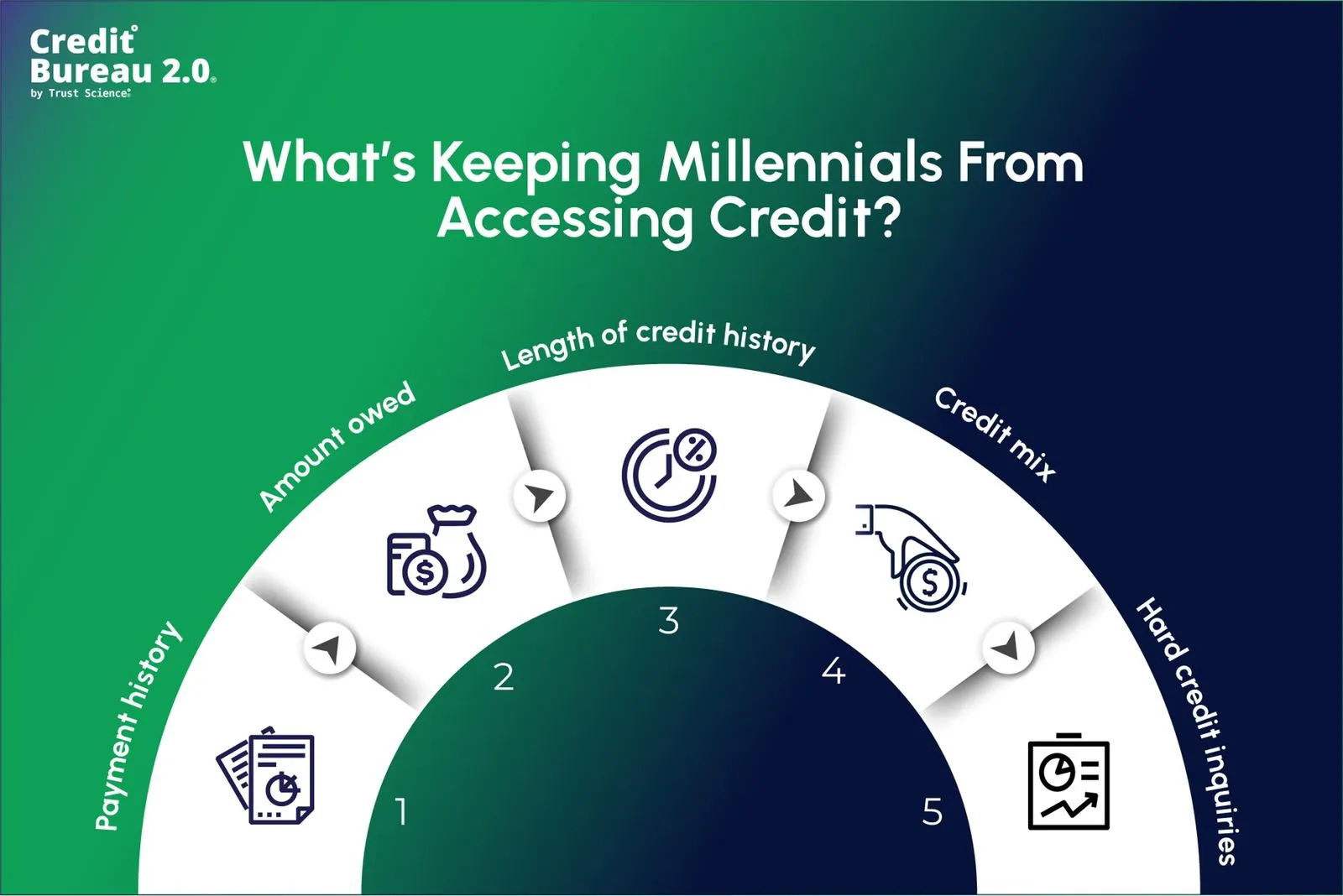

Big Time Daily: How Conventional Scores Are Stopping Most Millennials From Accessing Credit and How One Company Is Changing That

The concept behind a credit score seems simple enough. It tracks your credit history to see if you’re someone that a bank or lender can trust to pay back a loan. However, conventional credit scores just don’t account for the way that millennials and Gen Z handle their finances.

Continue Reading

Controlling What You Can Control And Anticipating What You Can't is Key to Planning

Our head of subprime automotive, John M. Giamalvo, shares his thoughts on how BHPH dealers can plan for success by focusing on what is within their control, such as profitability and portfolio delinquencies, using AI/ML decisioning platforms that leverage almost limitless data, like Credit Bureau 2.0 by Trust Science.

Continue Reading

Technology Innovators | Top 50 AI CEOs of 2021

Ensuring that Deserving People Get What They Deserve

Evan Chrapko, Founder and CEO of Trust Science, was selected to the Technology Innovators' Top 50 AI CEOs of 2021.

Evan shared his thoughts on addressing inequity in the lending industry and how Credit Bureau 2.0 is furthering financial inclusivity in a compliant way with more data and more predictive explainable AI algorithms.

Continue Reading

The Globe and Mail Report on Business A Score to Settle

The Globe and Mail Report on Business is a highly reputable Canadian publication similar to the Washington Post or Wall Street Journal.

Credit ratings often burden and enrage consumers, and the agencies that calculate them haven't changed much in over a century. Evan Chrapko and Trust Science are here to change that in the digital age.

Continue Reading

Come Together: AI and Machine Learning Help Break Down Silos and Optimize Performance

Today's BHPH business leaders should recognize that their business competitiveness, sustainability, and ROI are directly tied to team collaboration and training on predictive analytics.

Continue Reading

Optimize Capital and Cash Flow: the Capital is There and Automation Can Help You Treat it Right

Since COVID-19 stimulus money has poured into the US economy, bank deposits are up to $2,000,000,000. That's right, 2 TRILLION dollars. In this article, John Giamalvo, Head of Subprime Auto at Trust Science, talks about how to optimize your capital cash flow with the help of AI/ML models.

Continue Reading

Does a Positive "Perfect Storm" for Buy Here Pay Here Dealers Exist?

All the stars seem to be aligning to make 2021 a strong year for BHPH. More market need. More ability to pay. More data. More options to reach and align with customers. Market segment for BHPH dealers will be quite larger when we emerge from this crisis.

Continue Reading

Lending In a Time of Disaster: Alternative Data Offers a True, Consistent and Complete Picture of Credit Risk

While a credit report is still a good source of information, there is a need to complete the true picture of a consumer's ability to pay, given the potential for large inconsistencies in reporting.

Continue Reading

CLA Announces the Leaders-in-Lending Awards, presented by BMO Financial Group

Canadian Lenders Association (CLA), the voice of the innovative business and consumer lending industry, announces the Top 25 Lenders of 2019.

Continue Reading

Alternative Data for Credit Scoring: Add More Certainty - And More Prospective Customers

At the end of 2019, five federal regulatory agencies issued a joint statement advocating the use of alternative data in credit scoring.

Continue Reading

Trust Science featured in Auto Finance News article - Untapped Potential - How tech advances underwriting

From the outside looking in, underwriting may seem like the simplest and most basic of tasks, but this is not always the case.

Continue Reading

Silicon Review: Jeremy Mitchell as Chief Data Analytics Officer for Trust Science

Trust Science, which provides the Credit Bureau 2.0 ® service as a leading AI-powered credit scoring provider, announced that Jeremy Mitchell has entered the position of Chief Data and Analytics Officer.

Continue Reading

Trust Science CEO, Evan Chrapko Shares Digital Transformation Tips for Lenders in Article for BHPH Dealer Magazine

A complete digital customer journey can increase retention and recurring revenue for lenders. Consumers and/or borrowers are presented with a much more frictionless experience.

Continue Reading

Trust Science Featured In Auto Finance News Article on AI-Powered Underwriting

Trust Science, an AI-backed credit-decisioning software provider, is hoping to partner with a dozen LOS vendors by year end, according to Chief Executive Evan Chrapko.

Continue Reading

CLA Announces the Leaders-in-Lending Awards, presented by BMO Financial Group

Canadian Lenders Association (CLA), the voice of the innovative business and consumer lending industry, announces the Top 25 Lenders of 2019.

Continue Reading

Trust Science launches annual survey to discover underwriting pain points

Trust Science wants more details about the key pain points facing credit underwriters nowadays, so the provider of credit-scoring solutions powered by artificial intelligence recently launched its annual survey.

Continue Reading

Trust Science and Inovatec Systems partner for AI-fueled LOS system

TrustScience and Inovatec Systems Corp. finalized a partnership this week. The provider of artificial intelligence-fueled credit scoring and the loan operating system (LOS) provider announced they will partner to release a fully automated lending platform that can enable end-to-end loan management across the entire credit spectrum.

Continue Reading

Red Herring Crowns 2019 Top 100 North America Winners

The 2019 Red Herring Top 100 North America event came to a close on May 15th, as the best and brightest of North American startups were honored. The three-day conference was held at The Westin Pasadena and featured expert speakers, roundtable discussions, and presentations from shortlisted companies.

Continue Reading