See how Trust Science's AI-powered tools can help you find more qualified borrowers and improve your lending outcomes. Request a demo today to start making smarter credit decisions.

Resources

Trust Science’s Resources Hub is your go-to destination for a wealth of knowledge and insights. Explore our extensive collection of case studies, white-papers, economic monitoring tools, engaging blogs, interactive webinars, user-friendly implementation guides, and visually captivating infographics. Dive into our diverse range of resources to uncover innovative solutions, industry expertise, and actionable strategies.

.png?width=398&height=400&name=Group%207%20(1).png)

- All

- Articles

- Case Study

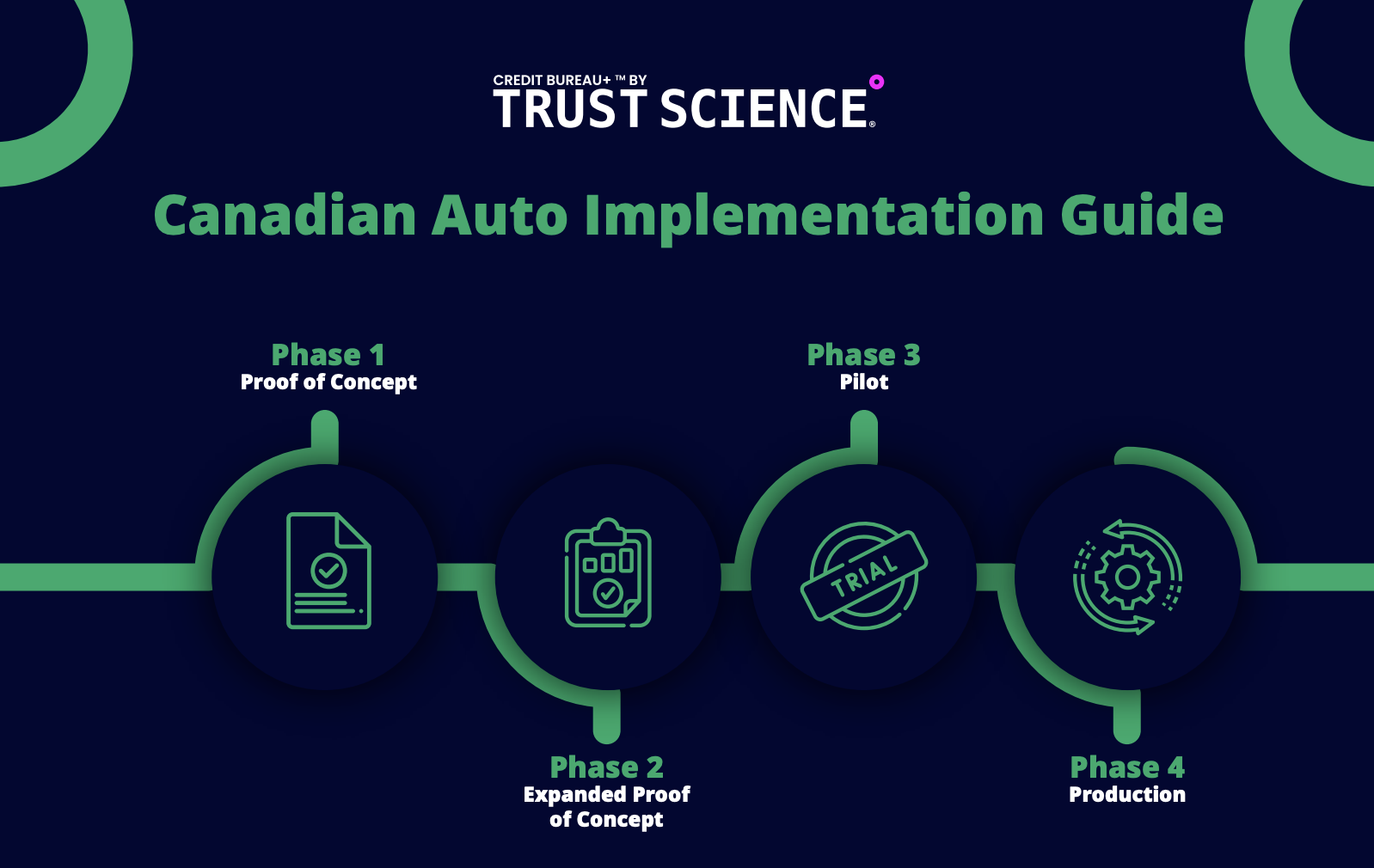

- Implementation Guides

- Infographics

- Webinars

Why auto finance is lagging in digital sphere

"The newest study from J.D. Power showed how auto finance companies are struggling in the digital space compared to their contemporaries in other industries."

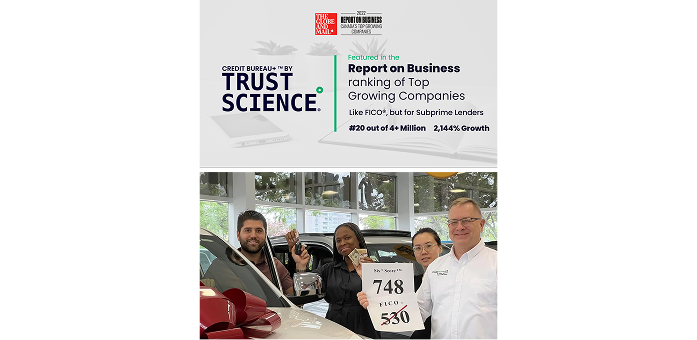

Trust Science Leverages Latest Tech to Help Lenders Better Assess Borrowers

"An Edmonton-based financial technology upstart is among Canada’s fastest-growing companies, according to an annual ranking from The Globe & Mail."

Conventional Credit Bureaus Are Broken: How AI, ML and Alternative Data Are Fixing the Credit Catch-22

"Roughly 1 in 5 adults in the US and Canada lack an accurate conventional credit score..."

Strategy Upshift: It’s time to rethink the FICO score

"Since being introduced in 1956 by engineer Bill Fair and mathematician Earl Isaac, the Fair Isaac Corporation’s (FICO) scoring..." *Auto Finance News Subscription Required*

95 companies transforming the Canadian fintech landscape

95 companies transforming the Canadian fintech landscape...

The Thoughtful Entrepreneur: Assessing Trust with Trust Science’s Evan Chrapko

"Trust Science aid preexisting data scientists or risk departments in assessing borrowers’ profiles..."

School For Startups Radio: Evan Chrapko

"The problem with the current credit bureau system is that it does a really poor job of scoring the bottom half of the population, so a lot of financial exclusion and structural inequities exist."

Startup Sales Strategy: How To Sell Your Technology Product With Evan Chrapko

Businesses need to think about who they can trust when making decisions in their businesses. It's difficult for entrepreneurs...

How Trust Science’s credit reporting technology helps serve the underbanked

After years of in-depth development of a highly complex and powerful platform, credit reporting agency Trust Science is...

Credit scores are broken. Fixing them is an alluring but elusive opportunity.

Credit scoring doesn’t work well for a lot of people. Those with low incomes, people of color and immigrants have been historically sidelined by the current system.

How To Lend Money To Strangers: Explainable AI and a new style of credit bureau, with Evan Chrapko

We eat volatility for breakfast, we make love to volatility! Which is handy, because we’ve all heard it, and, well, most of us have probably...

New York Weekly: Trust Science Empowers Nationwide Lenders with Highly Predictive Credit Scores

The events of the past two years have led to considerable financial upheaval, but...

Red Herring Crowns 2019 Top 100 North America Winners

The 2019 Red Herring Top 100 North America event came to a close on May 15th, as the best and brightest of North American startups were honored.

US Times Now: Trust Science® on The Importance of Financial Inclusivity in 2022 and ADMS

2022 has marked the exit out of the COVID-19 pandemic, and with it, a major shift to the credit industry...

Disrupt: Trust Science® on Increasing Financial Inclusivity In Black Communities

Trust Science® is here to offer lenders a reliable and inclusive way of assessment that helps individuals get the credit they deserve...

NEXUS Miami: Trust Science Welcomes TD Bank's Imran Khan as Advisor

AI/ML-powered credit scoring company Trust Science announced the addition of Imran Khan, Global Head of Innovation at TD Bank...

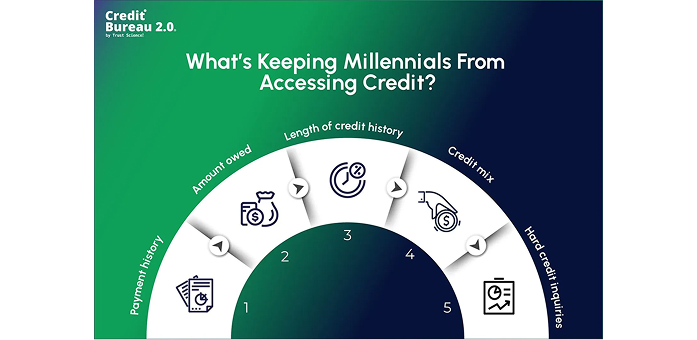

Big Time Daily: How Conventional Scores Are Stopping Most Millennials From Accessing Credit and How One Company Is Changing That

The concept behind a credit score seems simple enough. It tracks your credit history...

Installment Case Study

Learn how the Credit Bureau+ platform concretely helps lenders like you across the US.

Direct Mail Case Study

Find out how Trust Science revolutionized direct mail campaigns for a multi-state installment lender, increasing average deal size and response rates while shrinking the CPFL.

Auto Case Study

Read how Trust Science® helped a large BHPH auto dealer approve more borrowers and keep defaults steady in the midst of an uncertain COVID-19 credit market.

Alternative Data Credit Scoring Sources

Discover the broad range of data sources used for a custom credit score.

The Trust Science Difference

Everything you need to consider when automating loan underwriting in 5 steps.

Trust Science - Lending Updates from Q2

Trust Science EVP Corporate Affairs, Colin Tran, leads a discussion on how lenders are navigating the current environment.

Bring ML-Powered Decisioning To Life

A fireside chat session discussing how lenders could help underbanked borrowers using technology.

Interview With Evan Chrapko at FinTech Nexus 2022

Learn more about Invisible Primes™ and the Credit Bureau+™ platform from our CEO Evan Chrapko.

Prescreen & Direct Marketing

Our prescreening and direct marketing services align your underwriting criteria and marketing criteria ensuring the highest response and approval rates for your marketing campaigns.

Dinosaur Bureaus Face the Meteor of ML + AltData + B9

Learn how new technologies, new data, and blockchain/B9 are challenging traditional Credit Bureaus.

Trust Science Overview: Introduction to Trust Science

Learn how the Credit Bureau+™ platform helps lenders like you in real life.

#Fintech Breakfast Club Featuring Trust Science:

Discover the broad range of data sources used for a custom credit score.

LendIt Fintech Webinar: Seeing the Invisible Primes - Everybody Wins

Three Fintech CEO's discuss how to avoid the 5 deadly pitfalls when harnessing technology and seeking to boost lender ROA.

10 Ways to Screw Up Automation of Your Loan Origination

A fireside chat session with leaders sharing a survival guide for all lenders, especially Auto lenders.

Trust Science Technology Demo

Custom modules, automated decisioning, and access to Trust Science proprietary data.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)