Banking by Trust Science®

With Banking by Trust Science®, verify applicant banking information and review income sources, and gain cash flow insights allowing to reduce risk and default.

Adjudicate loans faster, more accurately and have up-to-date access to a customer’s KYC information.

Banking by Trust Science®

With Banking by Trust Science®, verify applicant banking information and review income sources, and gain cash flow insights allowing to reduce risk and default.

Adjudicate loans faster, more accurately and have up-to-date access to a customer’s KYC information.

KNOW YOUR CUSTOMER

Instant Bank Verification

Provide assurance of account ownership, account history, reinforcing your Know Your Customer (KYC) and Identify Verification (IDV). The Trust Science® banking platform validates critical information from banking data, reducing the risk of fraud and reduces friction for a positive experience.

KNOW YOUR CUSTOMER

Instant Bank Verification

Provide assurance of account ownership, account history, reinforcing your Know Your Customer (KYC) and Identify Verification (IDV). The Trust Science® banking platform validates critical information from banking data, reducing the risk of fraud and reduces friction for a positive experience.

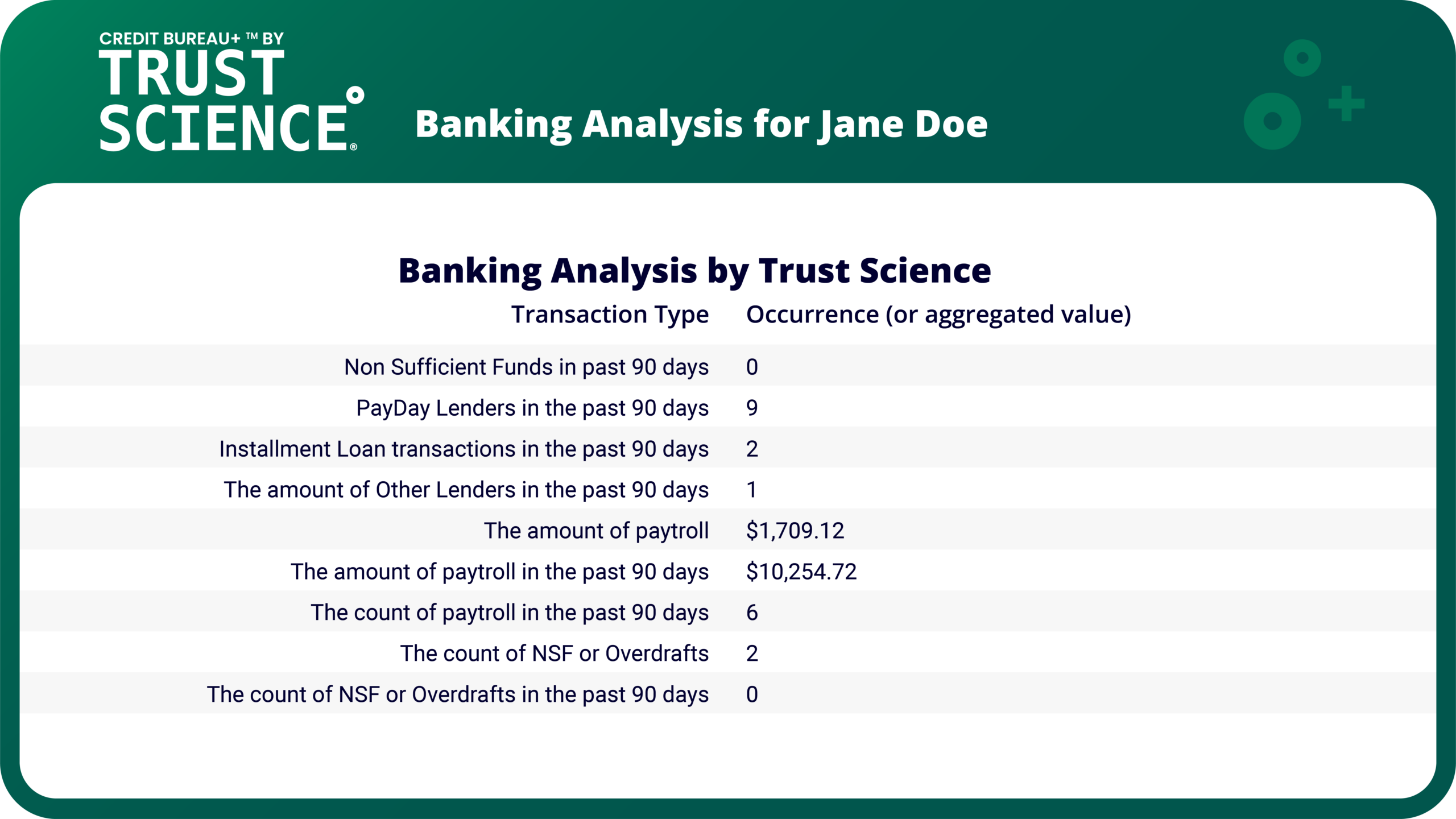

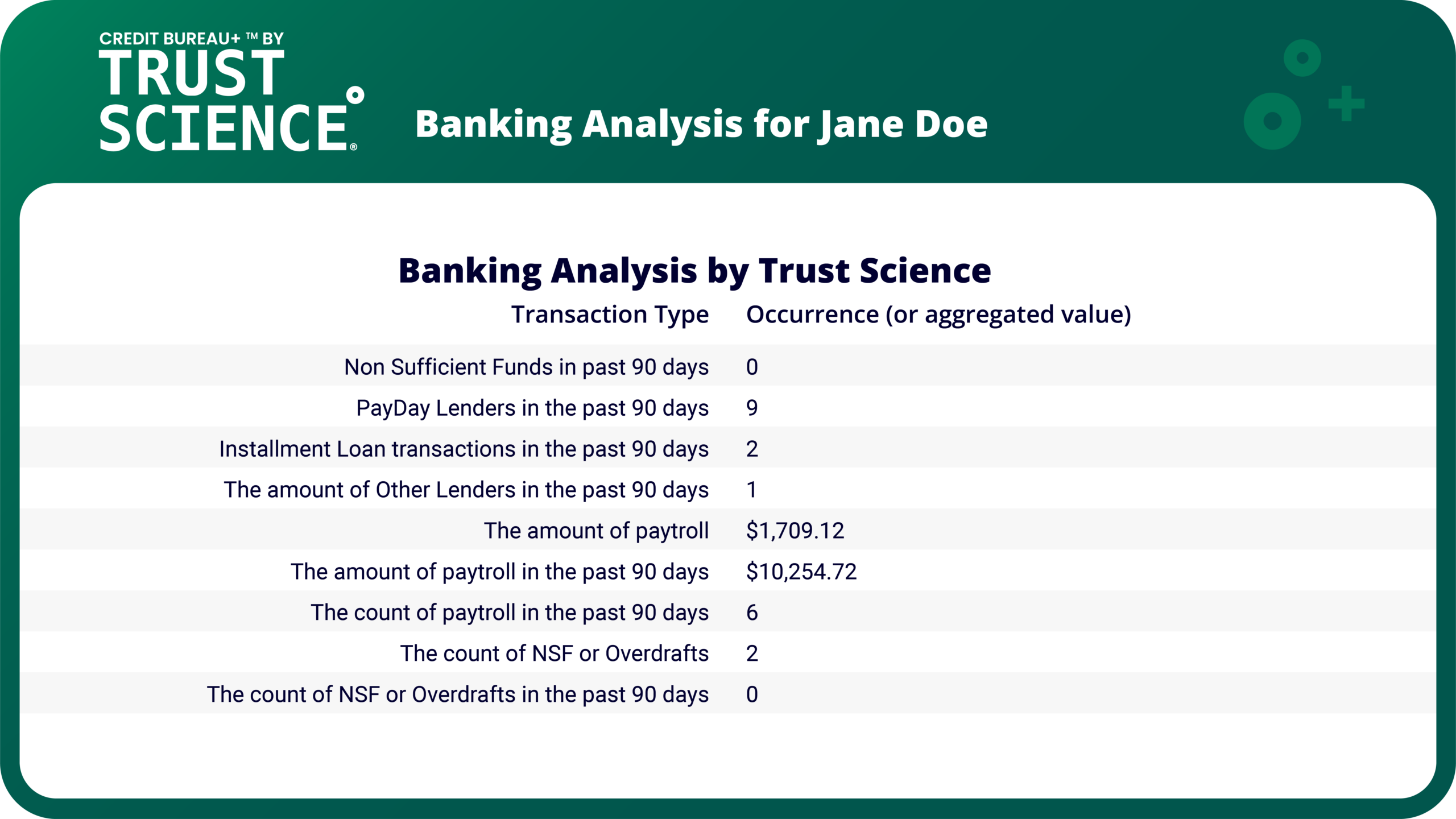

INSIGHTFUL DATA

Bank Summary

INSIGHTFUL DATA

Bank Summary

KNOW THE APPLICANT

Income Verification

Income and Employment data is amongst the most determinant when evaluating an applicant’s creditworthiness and their probability of default. With accurate, timely and verified income and employment data (VOIE), lenders can make the best underwriting decisions, ensuring they offer their customers the best products while managing their portfolio risk. At Trust Science®, our VOIE service is called SixPay™ and it is able to verify income sources, types and stability.

KNOW THE APPLICANT

Income Verification

Income and Employment data is amongst the most determinant when evaluating an applicant’s creditworthiness and their probability of default. With accurate, timely and verified income and employment data (VOIE), lenders can make the best underwriting decisions, ensuring they offer their customers the best products while managing their portfolio risk. At Trust Science®, our VOIE service is called SixPay™ and it is able to verify income sources, types and stability.

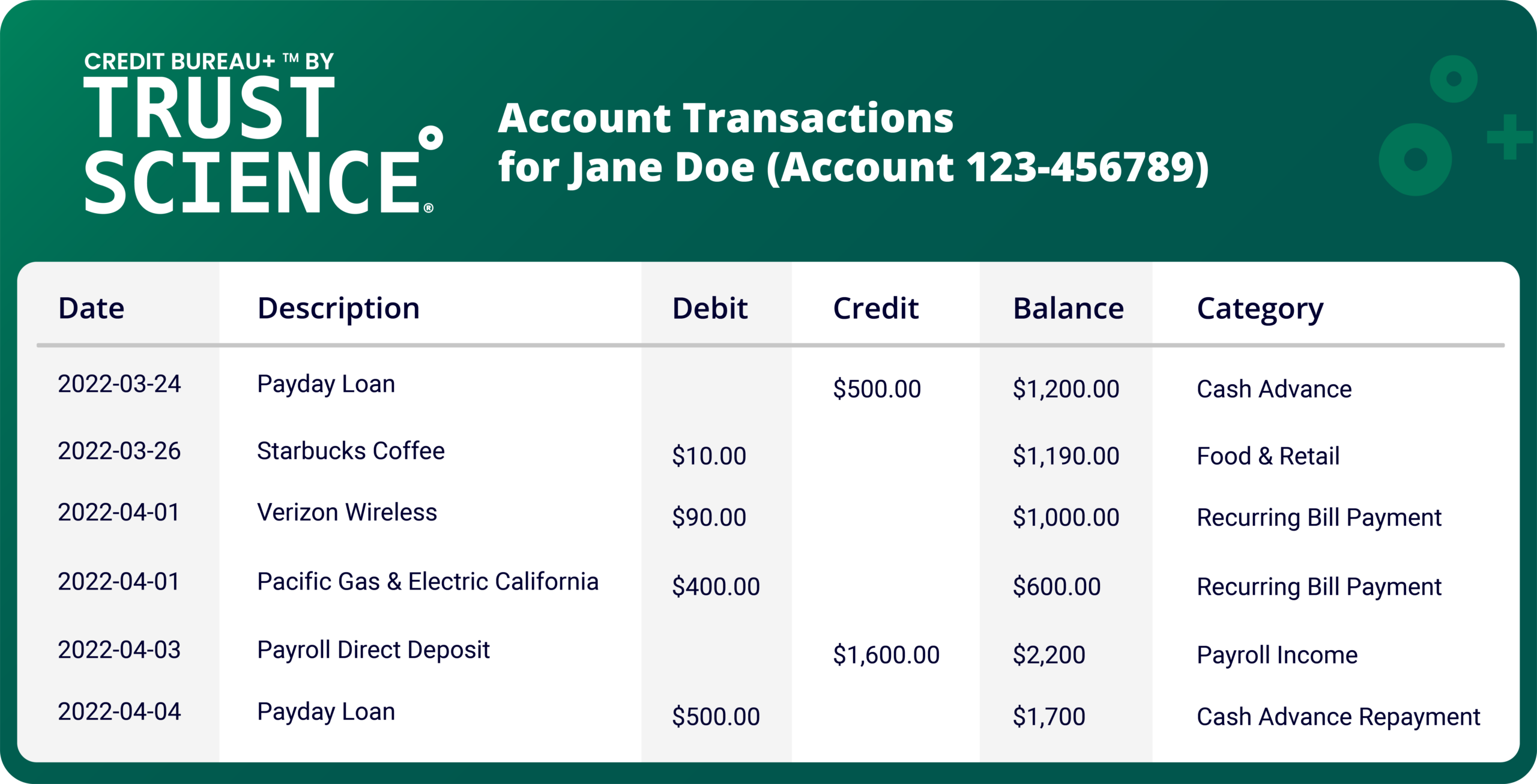

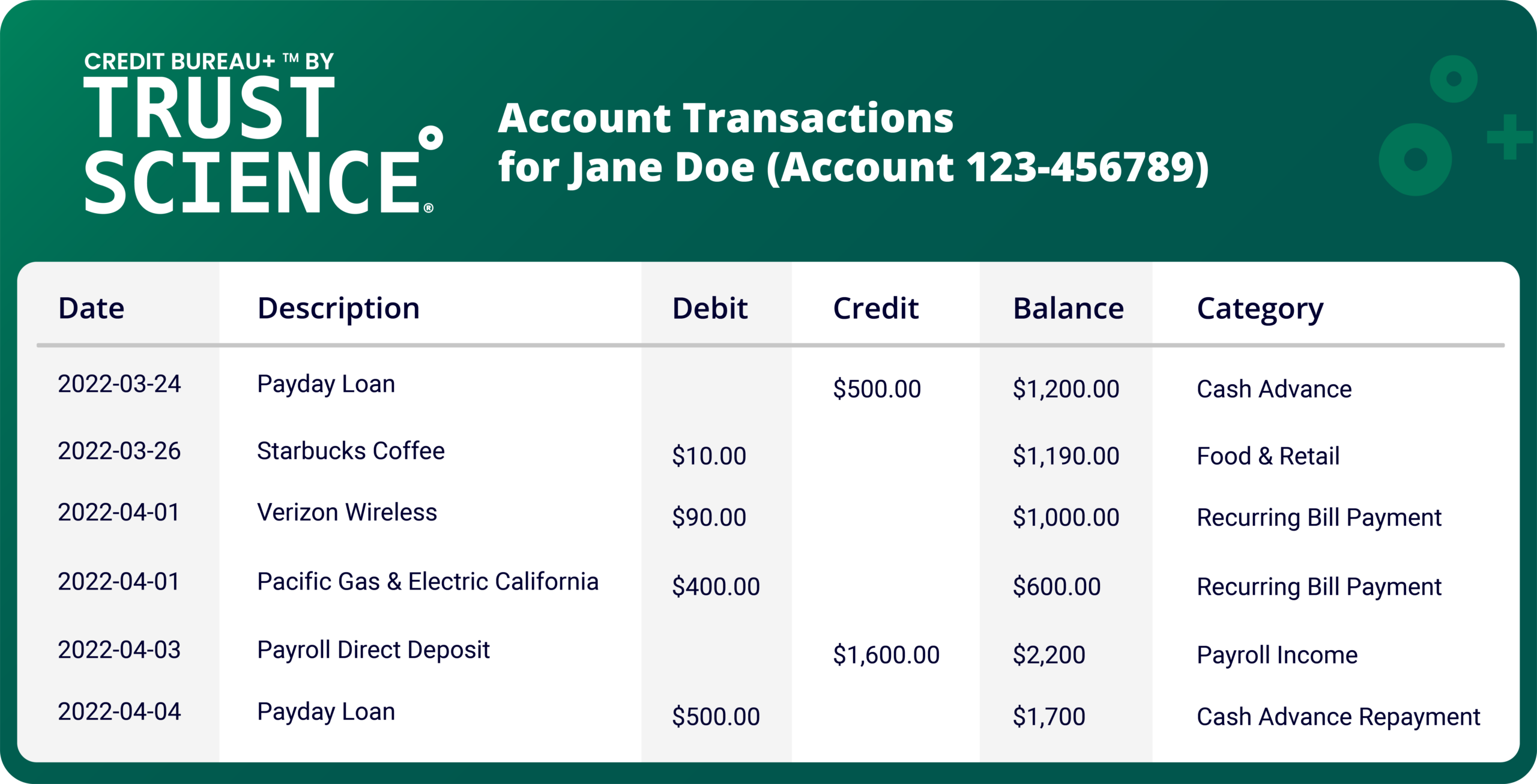

INSIGHTFUL DATA

Categorized Transactions

Get further details of transactional data to provide valuable insight into an applicant’s earnings, spending habits and debt obligations. Transactional data includes:

- Date & Description

- Category of Transaction & Amount

- Debit or Credit Value

- Account Balances

INSIGHTFUL DATA

Categorized Transactions

Get further details of transactional data to provide valuable insight into an applicant’s earnings, spending habits and debt obligations. Transactional data includes:

- Date & Description

- Category of Transaction & Amount

- Debit or Credit Value

- Account Balances

How do we Obtain Consented Customer Data in a Secure and Confidential way?

Trust Science obtains consumer banking through our Smart Consent™ platform. Smart Consent™ is a digital platform with a mobile and web interface where applicants can provide consent for a banking data pull from the comfort of home, at any time. We have full support for 10,000+ North American banks, and all the applicant needs is their login credentials for their bank.

Smart Consent™ can integrate into your existing application process or applicants can be directed to Smart Consent via an email.