Generally, people aged 31-50 are paying $160 more on food per person per month when compared to last year. What effects will this have on an average family Holiday dinner? From the Bureau of Labor Statistics, we compiled a typical basket of goods that a family may consume during the holiday season. The most recent data released is from September 2022. Given the volatile economic conditions, it is safe to assume that these prices will have fluctuated another 1-3% between then and the upcoming holiday season. First, let’s assume that the average holiday dinner consists of twelve people, assuming a family of four with invited relatives and friends. We have compiled a list of classic North American Holiday dinner items: turkey, mashed potatoes, fresh vegetables, condiments, ice cream, wine, and other miscellaneous items potentially used to make a wonderful dinner.

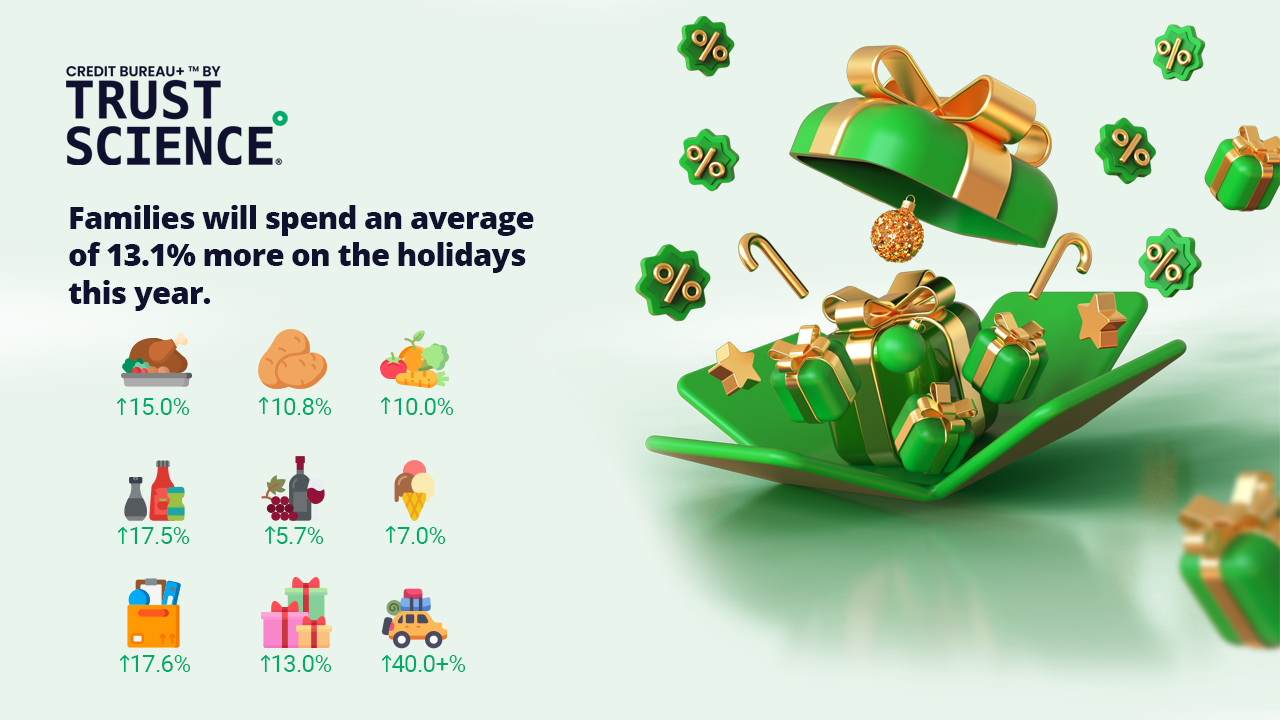

Based on these price increases, the total of a basic Christmas dinner is now $177.63, up from $156.94 or a ~13% total increase in cost. It is important to note that these are only the bare essentials of a holiday meal; if you begin to incorporate homemade cakes, pies, and other specific delicacies, costs can rapidly increase by another $50-100.

For families with young children, presents are the most critical and expensive part of the holiday season. As the years tick on, gifts are becoming even more costly than ever before. Even LEGOⓇ, the most basic of children’s holiday gifts, has increased by ~13% in the past year. This increase alone beats cumulative CPI by a landslide and puts families in a more difficult position than ever before. Many popular children’s toy manufacturers, including MGA, will produce shrunk-down toys at lower price points. The Bratz dolls producer is currently on track to make 200 toys this holiday season under $10, up from 15 toys last year. However, these more attractive price points come at the cost of quality and, as previously mentioned, size.

After almost three years of being stuck in their homes due to COVID-19, families are booking plenty of vacations to make up for it all. As with most things this year, they, too, have increased in cost by far the highest of all. Not only due to inflation but also due to the substantial increase in demand. If you’re visiting family out of state or province, you’ll be paying almost 33% more for your airfare this year than in 2019. But, costs quickly add up even more if you are on a tropical vacation. STR, a company that provides market data on the hotel industry, reports that the average room rate in the US has increased by 21.4% from 2019 to almost $153 a night. The Bureau of Labor Statistics CPI also indicates that restaurant prices have increased by 8% yearly. These factors create a dangerous situation for families looking to escape their hometown this holiday season. Will people still be able to afford their current lifestyle based on these crippling financial situations?

There is no doubt that the cost of this holiday season is going to be extreme for most families. As cost pressures increase across the board, lenders are facing an increased demand for credit while also facing volatile patterns in the economy that leave conventional credit assessment unreliable. Helping expand access to fair credit products, without increasing risk, will help set lenders apart this holiday season, supporting consumer liquidity and growing their businesses: having fair and accurate credit assessment methods, especially on historically underserved/underbanked people, will be critical to this mission.

Trust Science helps deserving people get the credit products they deserve, helping lenders Find Great Borrowers From Lead to Loan™. With over 90 million credit invisibles across the US and Canada, Trust Science is here to support a happy holiday season with financially inclusive and accurate credit insights from lead sourcing and screening to loan decisioning.

Have thoughts on the rising costs of the holidays and their impact on credit? Leave a comment below!