Conventional Credit Bureaus Are Broken: How AI, ML and Alternative Data Are Fixing the Credit Catch-22

This article was originally posted by Enterprise Viewpoint here:

https://enterpriseviewpoint.com/conventional-credit-bureaus-are-broken-how-ai-ml-and-alternative-data-are-fixing-the-credit-catch-22/

By Evan Chrapko, Founder, Chairman & CEO, Trust Science

May 18, 2023

Roughly 1 in 5 adults in the US and Canada lack an accurate conventional credit score, disproportionately impacting underbanked, new to credit, and new to country consumers. Through a global pandemic, economic volatility, and substantial shifts in our way of living, the once-trusty credit scores and bureaus the financial services industry relies on today have been proven to become inaccurate and exclusionary, causing measurable pain for millions of consumers daily and leaving them on the outside of the modern economy.

Why Are Millions of Deserving People Failed by Conventional Credit?

Conventional credit rating systems are driven by four primary factors:

- Credit and Repayment History

- Credit Utilization & Amount Owed

- Credit Product Mix

- Inquiries for Credit

This creates several factors that leave underserved consumers without fair and accurate assessment that amount to a Credit Catch-22™: good credit is needed to get fair credit products to build a credit history, but a well-built credit history is required to access these products. When inputs to creditworthiness assessment are based strictly on credit-related factors, new-to-market or previously underserved consumers that seek to get access to credit or other financial services are inherently disadvantaged and become excluded from credit products that, if a more complete view of creditworthiness was available, these individuals should have been able to receive and repay just like their “prime-according-to-FICO” counterparts. Because of this limited view of risk, lenders are left unable to extend credit to (and hence exclude) creditworthy applicants and are missing opportunities to gain clients with a high lifetime value.

Furthermore, because credit rating approaches temporarily punish consumer-initiated requests for credit, credit-conscious consumers are discouraged from applying for products they believe they would be unlikely to receive, despite being qualified and able to afford payments. The credit scoring system has a steering effect that guides underserved borrowers away from even applying for products they would deserve and are instead left with suboptimal loans with more aggressive repayment terms that can perpetuate a cycle of debt (or left with no loans whatsoever).

Alternative Data and AI Present a More Holistic and Inclusive View of Risk

Alternative data that captures a wider range of financial activities has enabled lenders to get a more accurate assessment of an applicant’s financial health outside of the conventional credit system. As mortgages and automotive loans (seen as the “crown jewels” of credit reports) become less common, and unstructured financial activities, such as gig workers (e.g., rideshare, online freelancing) and non-debt asset purchases become more commonplace, getting this broader perspective is incredibly valuable to including otherwise-invisible deserving borrowers. Data from asset ownership and rent payment data (which is remarkably excluded from conventional credit) to consumer-consented data like banking and payroll data empowers lenders to see this broader range of financial activity and make more accurate decisions.

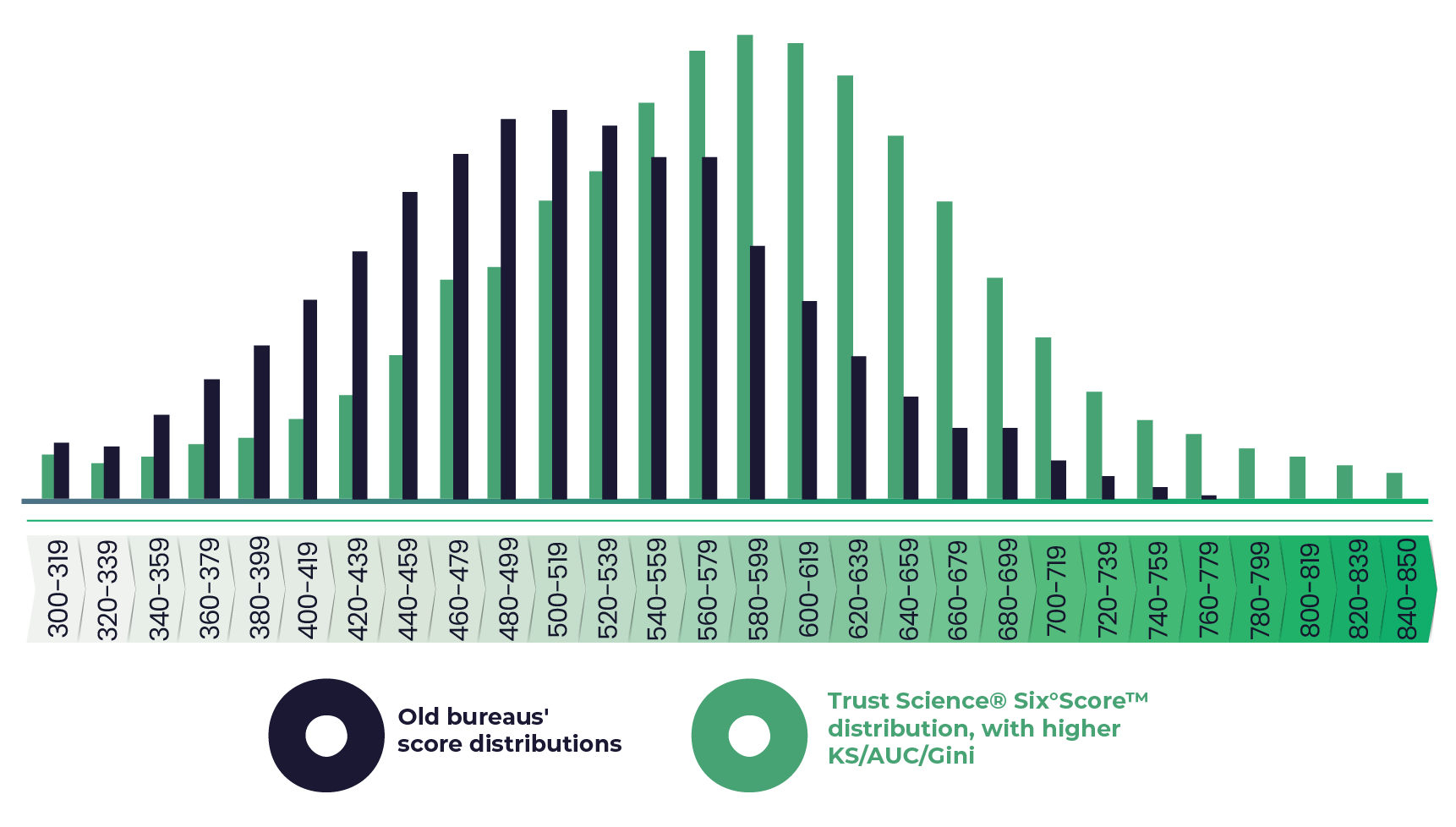

The vastness of this data, however, makes “old-school” methods like regression or scorecards inefficient and fail to unlock its full predictive potential. Explainable AI models, especially when built on a machine learning platform that can learn from new data and rapidly adapt to economic changes, expand the practical limit of data points from a few dozen to a few thousand, and can automatically provide a holistic and accurate assessment within seconds. When measured by statistical tests of model predictiveness like the Kolmogorov-Smirnov (KS) test, Trust Science® has seen our AI models outperform conventional models by 20-70%, which directly translates to an improved ability to extend credit to the right consumers, leading to increased approvals (i.e., inclusion) of previously declined deserving borrowers, decreased defaults, and improved overall lender profitability.

Top-of-Funnel Inclusion: Solving Self-Selection Bias

While having better risk assessment on an existing pool of applicants is a key step towards more financially inclusive lending, expanding that pool of applicants to include qualified individuals that may have otherwise applied elsewhere (and potentially have been subject to more aggressive repayment terms) yields a level of potential to rapidly (and profitably) expand lending capabilities and break down barriers to credit.

By bringing risk and propensity assessment to the top of the funnel across both digital (e.g., purchasing leads) and physical (e.g., direct mail) channels, lenders are empowered to make pre-approval offers to prospective customers, which provides applicants with the security that they will receive credit when they complete an inquiry on their credit file, and eliminate self-selection biases. Applying an alternative view of consumers with alternative data and AI at the top of the funnel empowers lenders to expand their lending horizons beyond those they previously considered and begin including these Invisible Prime™ consumers in their lending businesses, without increasing risk, and therefore allowing these lenders to safely grow to serve new/previously underserved markets. Working with lenders, Trust Science has seen incredible results from these types of deployments, with average deal sizes increasing over 50%, conversion rates rising to 2-4x of their previous levels, and approvals climbing over 50%.

Key Takeaways: Financial Inclusion is Possible with FinTech

FinTech is paving the way for a more inclusive, more equitable, and more profitable financial future, and lenders that are leading the adoption of these technologies are seeing the benefits to their businesses. With the limitations in conventional credit excluding those without a well-developed credit history and steering deserving-yet-underserved borrowers away from financial services they deserve, lenders are increasingly seeking alternative methods to help them better serve consumers. With the power of alternative data unlocked by innovations in explainable AI and ML, lenders are no longer restricted to a narrow view on creditworthiness and can make better credit decisions that expand the population of risk-appropriate borrowers. Leveraging these technologies across the lending lifecycle, lenders can include underserved demographics and better serve their existing markets by bringing in more qualified applicants at the top of the funnel, and successfully approving deserving consumers for loans.

Press Contact:

Evan Chrapko

Founder, Chairman & CEO

Trust Science

[email protected]

403-585-3826