Lenders now have the ability to reliably find, score, lend to, and manage the loans of 64 million unbanked and under-banked consumers in the United States alone.

Lenders can be up and running on a fully customized LOS and an AI-powered loan underwriting model within weeks, not months (or years).

Trust Science CEO Evan Chrapko comments, “This partnership gives lenders the ability to accurately score and lend to an additional 64 million consumers in the US alone, with unprecedented accuracy and speed. The end-to-end, customizable nature of Inovatec Systems’ LOS makes it a perfect partner for Trust Science and our API-based scoring solution.”

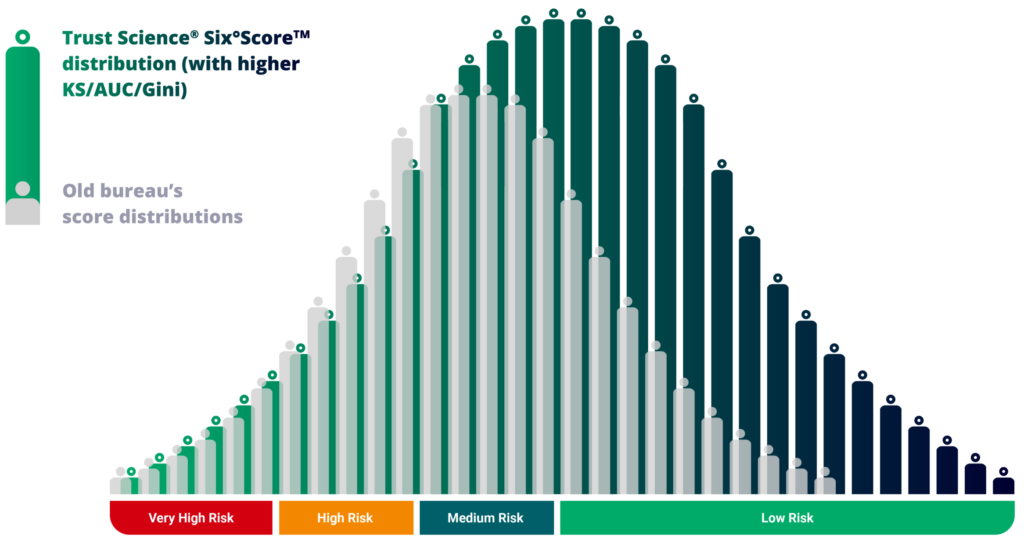

Bryan Smith, VP Sales & Marketing at Inovatec shares a similar sentiment, “With this partnership, Inovatec Systems will now be able to automate the powerful AI tools at Trust Science alongside traditional credit scoring and risk measurements. Our lenders will have instant access to the Trust Science Six°Score™ to determine creditworthiness based on alternative, uncorrelated data, generating simple and powerful results for a more complete risk assessment of the individual.” He continues “The Trust Science tools will be integrated into our Compass Asset Finance (CAF) for credit and funding, driving more innovation and thinking differently.”

Mark Eleoff, CEO of Eden Park Inc, and a customer of Trust Science and Inovatec Systems remarks, “Both Trust Science and Inovatec Systems have proven themselves to be innovative, value-added and very customer centric in working with us to improve our credit decisions.”

A BETA version of the integration has been underway for several months, and General Release is expected in June.

About Trust Science Inc.

Trust Science provides AI-powered alternative credit scoring to lenders, helping them sift prime borrowers from wrongly scored subprime applicants. Trust Science gathers alternative unstructured data and consented mobile data using its patented (30+ patents across 6 countries) data collection methods, and builds custom underwriting models for short term, installment, direct auto and indirect auto lenders. Lenders see increases in their loan origination volumes, reduction in default rates and double digit ROI. For more information please visit www.trustscience.com

About Inovatec Systems Corp.

Inovatec Systems Corporation provides industry leading, cloud-based software solutions for any financial institution, any type of transaction. All solutions can be brought together in a single seamless and branded platform that can be opened to external partners and customers. Capture any marketplace – Full, robust ecosystem to drive the online customer/lead to you, streamline and facilitate the processes of crediting, auditing, funding and income verification for financing applications plus full servicing & portfolio analytics in the leading-edge LMS. For more information please visit www.inovatec.com