As a leader in the use of explainable AI (XAI) and machine learning (ML) in the credit industry, Trust Science® has submitted information and comments on “Financial Institutions’ Use of Artificial Intelligence” to the Consumer Financial Protection Bureau (CFPB) and other US regulatory agencies. Trust Science’s guidance will support and guide the regulating atmosphere, ensuring lending leaders that our proprietary technologies are fully compliant while delivering high-performing scoring and models.

Trust Science recognizes the challenges for financial regulatory agencies seeking to provide guidance on the prudent and effective use of Artificial Intelligence and Machine Learning (“AI” or “AI / ML”). Trust Science supports those efforts and recognizes the applicability of Artificial Intelligence and Machine Learning to facilitate the provision of credit to financially stressed or under-banked borrowers in a fair & ethical way.

The below content has been adapted from our submission. To request access to our complete submission, please contact us.

Key Points

- Trust Science has demonstrated that XAI and ML results in better assessment of risk when compared to traditional regression or rules-based approaches.

- Our XAI and ML technology has numerous applications in fintech solutions beyond probability of default.

- XAI and ML lead to fully compliant, ethical, and fair assessments that outperform traditional methods.

Adapted Submission to Regulatory Agencies

Improved Lending Performance

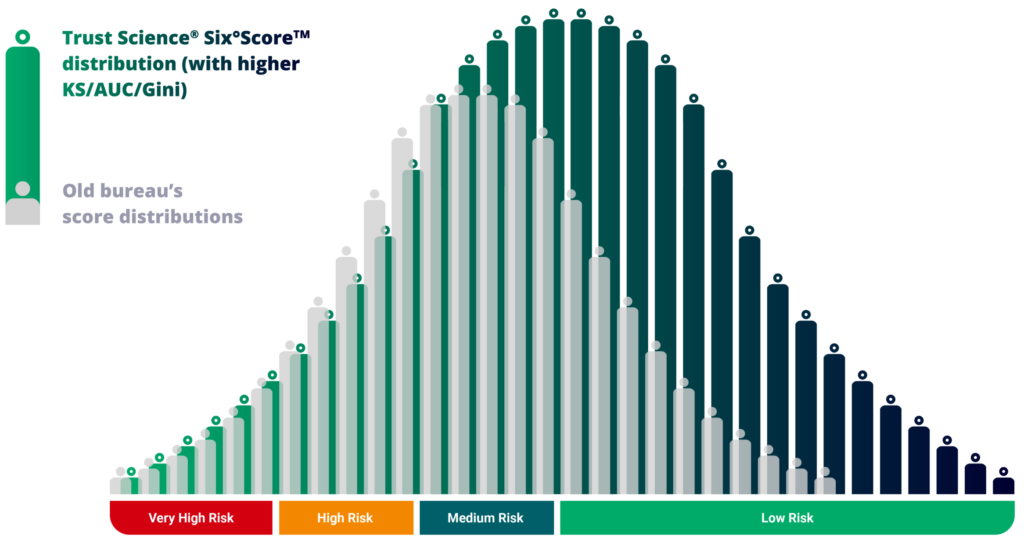

Trust Science has found that the use of AI/ML results in substantially better assessment of risk versus traditional regression and rules-based systems, especially for consumers scored as “subprime” by traditional methods. With our more powerful models and technology, Trust Science is able to parse and analyze tens of thousands of data points beyond manual approaches, leading to more prediction accuracy.

This means that Trust Science clients, through our fully compliant products, receive:

- Deeper insights into the subprime market to sift out the Invisible Primes™

- The ability to lend deeper into the market for increased originations at the same risk gradient

- Substantially boosted ROA and ROI

Diverse Use Cases for Financial Institutions

The financial sector, with its quantified and structured data, is primed for the addition of AI and ML scoring/modelling to boost efficiency. While self-learning, dynamic AI solutions are limited in that they require vast amounts of data and thus is generally best used for short performance windows or for lenders with high application volumes, Credit Bureau +™/Credit Bureau 2.0® by Trust Science have both standard models which allow smaller lenders to leverage a collectivized data bank and custom models which allow for solutions specifically tailored to your data and particular use cases.

Trust Science is also developing the ability to delivery the following, beyond standard probability of default (PD) and credit scoring:

- Recommended Loan Amounts

- Optimized Pricing and Terms

- Data-Driven Decisioning Throughout the Underwriting Process

Compliance: Explainability, Ethics, and Fairness

Trust Science is fully committed to ensuring that our technology and solutions are 100% compliant and provide lending leaders with the power to extend credit to deserving borrowers, even those that are financially stress or underbanked, in a fair and ethical way.

This means we provide:

- Transparency in the form of ranked, compliant, and easy-to-understand adverse action reasoning with actionable insights

- Fully compliant scoring systems that are actively monitored to ensure they do not discriminate on any prohibited factor(s)

- Increased inclusivity through considering a broader, more inclusive data set