Jeremy was formerly Vice President of Analytic Solutions Consulting, Equifax. There he supported over $340M in annual revenue and previously owned product development responsibilities for product portfolios in excess of $100M.

Jeremy will leverage his 20 years of industry experience to oversee two key pillars in Trust Science’s SaaS platform, both alternative data and also analytics. Trust Science produces custom scores using not only a lender’s historical records but also proprietary data and publicly-sourced data, all powered by machine learning and AI. Lenders benefit from automation at scale and previously unattainable decision support at the lower end of the credit spectrum.

“We’re proud to have Jeremy join us to help define underwriting across the planet, for the 2020’s,” says Evan Chrapko, CEO and Founder, Trust Science. “Jeremy was a member of the original development team that created VantageScore, a credit score to compete with the traditional FICO score. We love compliant, powerful disruption.”

“Trust Science is leading the trend to give consumers access to relevant information and give them control over who accesses their information,” says Jeremy Mitchell, Chief Data and Analytics Officer, Trust Science. “Trust Science is building solutions that benefit both the consumer and the lender. This decade will see the world expect Alternative Data and AI to be harnessed for social good, like Financial Inclusion.”

About www.TrustScience.com USA Inc.

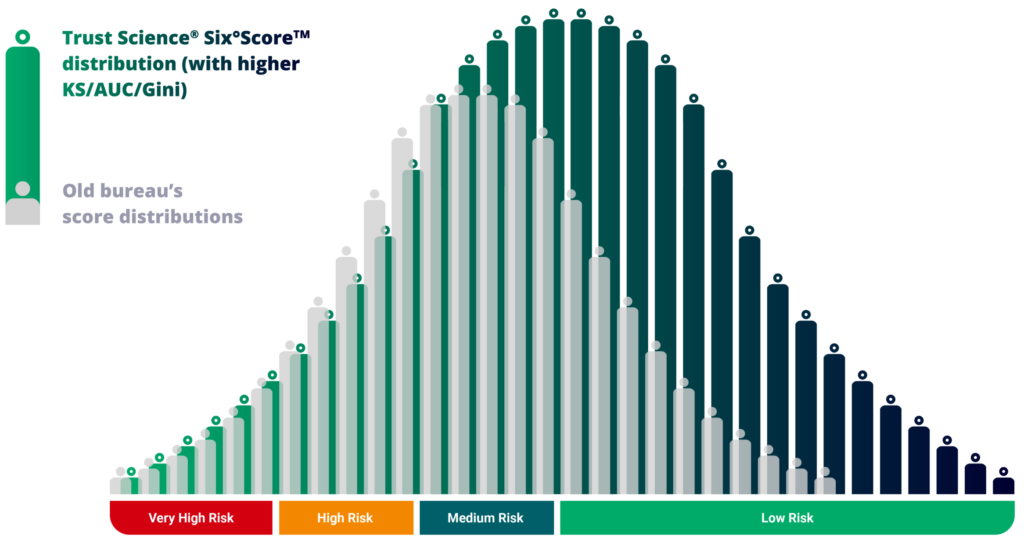

Trust Science ® builds and delivers Credit Bureau 2.0™ This is the world’s leading provider of AI-sourced and AI-analyzed alt.data to generate highly predictive credit scores for lenders around the world. Trust Science sifts Prime-quality loan applicants out of the wrongly-scored, so-called Subprime pool. Optionally, the system can also obtain consented mobile data using its patented (30+ patents across 12 countries) data collection methods. Lenders get increases in their loan origination volumes, reduction in default rates and double-digit ROI thanks to reduced OpEx from more automation and fewer human errors. Trust Science is a winner of the Red Herring North America Top 100 award, and “Smartest Companies to Watch” from Cherokee Media.