The Trust Science® Advantage: Installment Lending Case Studies

- Conventional Score Approaches

Despite a rapid evolution in the credit market, over 65 million Americans remain excluded from traditional credit opportunities due to a lack of credit history or access to traditional financial services: roughly 1 in 5 people are credit invisibles out of the view of the traditional credit bureaus.

According to Credit Info Center, a traditional credit score, as determined by the three primary credit scoring bureaus in the United States, is usually determined strictly by a borrower’s line of credit. These bureaus will look at a limited set of information, including payment history, amounts owed, length of credit history, new credit, and credit mix, to determine a score typically between 300 and 850. These criteria are not only incredibly limited in insight, but are also restrictive and exclusionary to the millions of underbanked and financially stressed Americans seeking to develop their credit. As a result, traditional credit bureaus are unable to generate an accurate credit score for approximately 53% of Americans while labeling over 50% of Americans as less-than-ideal borrowers. Due to the limited competition in this space, lenders have become over-reliant on antiquated and rigid data and scoring systems, facing barriers in the fair and ethical scoring of specific groups of creditworthy prospects, such as immigrants and millennials. Put simply, traditional credit scoring only offers rigid and limited insight to lenders with inadequate assessment of significant sectors of creditworthy prospective borrowers.

- The Trust Science® Approach

“This solution is transformative in the under-served, financially-excluded sector of the economy. It can score thin files and no hits, and it can do so in a fluid credit environment.” – Natalie Bell – COO – Magical Credit

According to research by Duke University (2019), behavioral data is as informative as people’s credit bureau scores. Knowing this, traditional bureau data is just one facet of Trust Science® scoring: Trust Science® also leverages public data, proprietary data and consented data to produce highly predictive credit scores. These data sets are processed by the Trust Science’s® cloud-based SaaS decision support platform to promptly deliver a fully compliant and explainable AI- and ML-powered score. As a result, Trust Science’s Six°Score™ identifies a larger pool of creditworthy customers with increased accuracy and insight into probability of default, probability of delinquency and ability to manage payback. By delivering data-backed and AI-driven insights that help deserving people get the credit they deserve, Trust Science® gives lenders the ability to improve loan inclusivity, expand their loan originations, and grow their business with absolute confidence in their decisioning process.

- Case 1: U.S. Retail Installment Lender

A large installment lender was challenged, in the midst of an uncertain COVID-19 credit market, with finding more leads and increasing originations while lowering defaults. Before partnering with Trust Science®, this installment lender used lead generation and direct mail marketing campaigns with poor results due to a low response rate and a high default rate. With Trust Science® this installment lender was able to sift “prime” borrowers out of a pool of wrongly-scored “subprime” borrowers to increase new loan originations by over 50% and reduce charge-offs by 24.5%.

How did this lender expand their model to better identify prospective borrowers, significantly grow their business while decreasing losses due to default? With the power of Credit Bureau +™ by Trust Science®: a wealth of alternative data analyzed by proprietary artificial intelligence and machine learning technology and synthesized into fully compliant and easily explainable Six°Scores™, offering highly accurate risk scores that enable more effective and inclusive lending decisions.

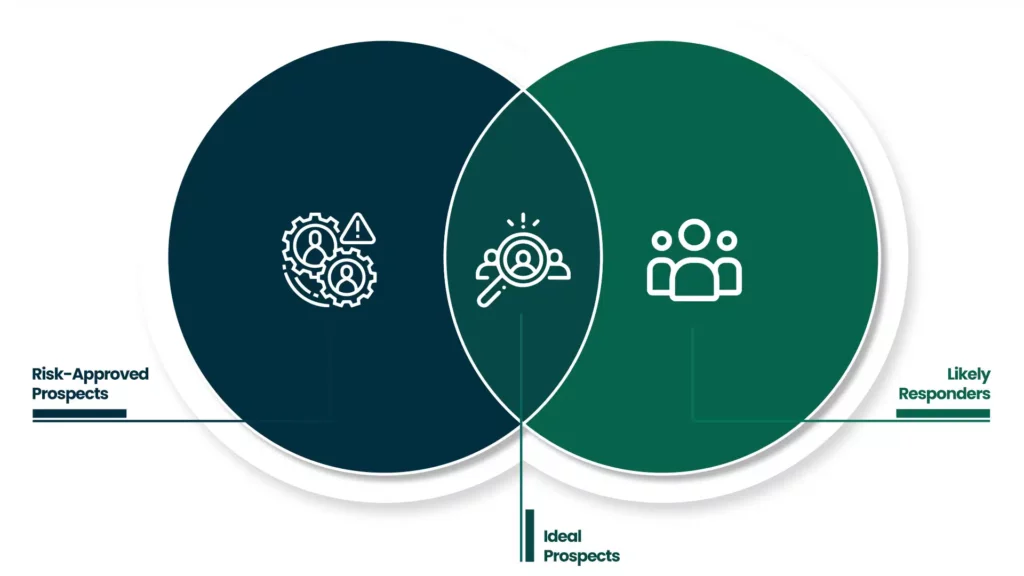

Trust Science® uses this same technology and approach to identify a pool of prospects for a client’s marketing campaigns. Our approach optimizes for prospects that are creditworthy and that are likely to respond to our client’s outreach efforts. Based on a client’s criteria, risk tolerance and business objectives, Trust Science® can create and screen a prospect list for marketing campaigns that will improve response and approval rates while reducing default rates. Additionally, Trust Science® uses the same criteria for underwriting decisioning as for identifying and prescreening prospect lists, meaning more prospects will be approved when they walk in the door.

In the case of this installment lender, their direct marketing campaign approval rate climbed to +90%. In two months their direct mail marketing campaign drove $6.2MM in new originations with lower default rates than organic walk-ins. New originations climbed to 57% of funded loans. Perhaps what is more impressive is that these results were achieved without the use of a client-specific, custom model but with one of Trust Science’s® ready to deploy, industry-specific models, meaning a solution was in production in weeks, not months.

Trust Science® does more than just identify good borrowers, we help lenders optimize revenue against risk. It’s one thing to decide who to lend to; it’s another thing to know how much to lend to them. Trust Science® can also provide risk-based Recommended Loan Amounts to help lenders increase the value of loans without exceeding their tolerance for risk. These Recommended Loan Amounts can be used in direct mail marketing campaigns to increase response rates of prescreened prospects. In the case of this installment lender, they saw a 50% increase in loan amounts for new loan origination.

- Case 2: U.S. Online Installment Lender

A large online installment lender was challenged with increasing originations, opening new customer populations and decreasing first payment default (FPD) rates and overall default rates. Before Trust Science®, this lender was using Experian Clarity and TransUnion to identify and segment leads into high quality and low quality leads, respectively.

This lender opted to go with a Trust Science® custom solution that incorporated a two-model approach: one model to evaluate the probability of default and a propensity model to optimize lead conversion. With this custom solution, Trust Science® also devised a strategy to optimize profitability based on risk targets, decision thresholds, population segmentation and product matching.

With the Trust Science® custom Six°Score™, the Experian Clarity lead segment had a 11% lift on the Kolmogorov–Smirnov (KS) test for default and 40% lift for conversions. This contributed to a 68% increase in conversions and a 17% reduction in FPD. The TransUnion lead segment had a 41% KS lift for default and 38% lift for conversions. This contributed to a 3x% increase in conversions and a 15% reduction in FPD.

Overall, the move to Trust Science® resulted in this installment lender seeing a 3.7x ROI and a 5.8x ROI for their Experian and TransUnion segments, respectively.

Impacts

By using Credit Bureau +™ by Trust Science® and Six°Score™, these installment lenders were able to lend to more people with confidence in their ability to avoid defaults, witnessing substantial earnings growth and ROI quickly after implementation. Trust Science® is an industry leader in its ability to use AI/ML models that grow with your business, harnessing its numerous data sources to deliver meaningful, explainable, and fully compliant risk scores, even on those that were conventionally thought of as credit invisibles. For lending leaders who need to score financially stressed or underbanked borrowers in a fair and ethical way, Trust Science® offers a fully compliant, data-driven, AI-powered solution, right now. Learn more about Trust Science® at their website: trustscience.com.