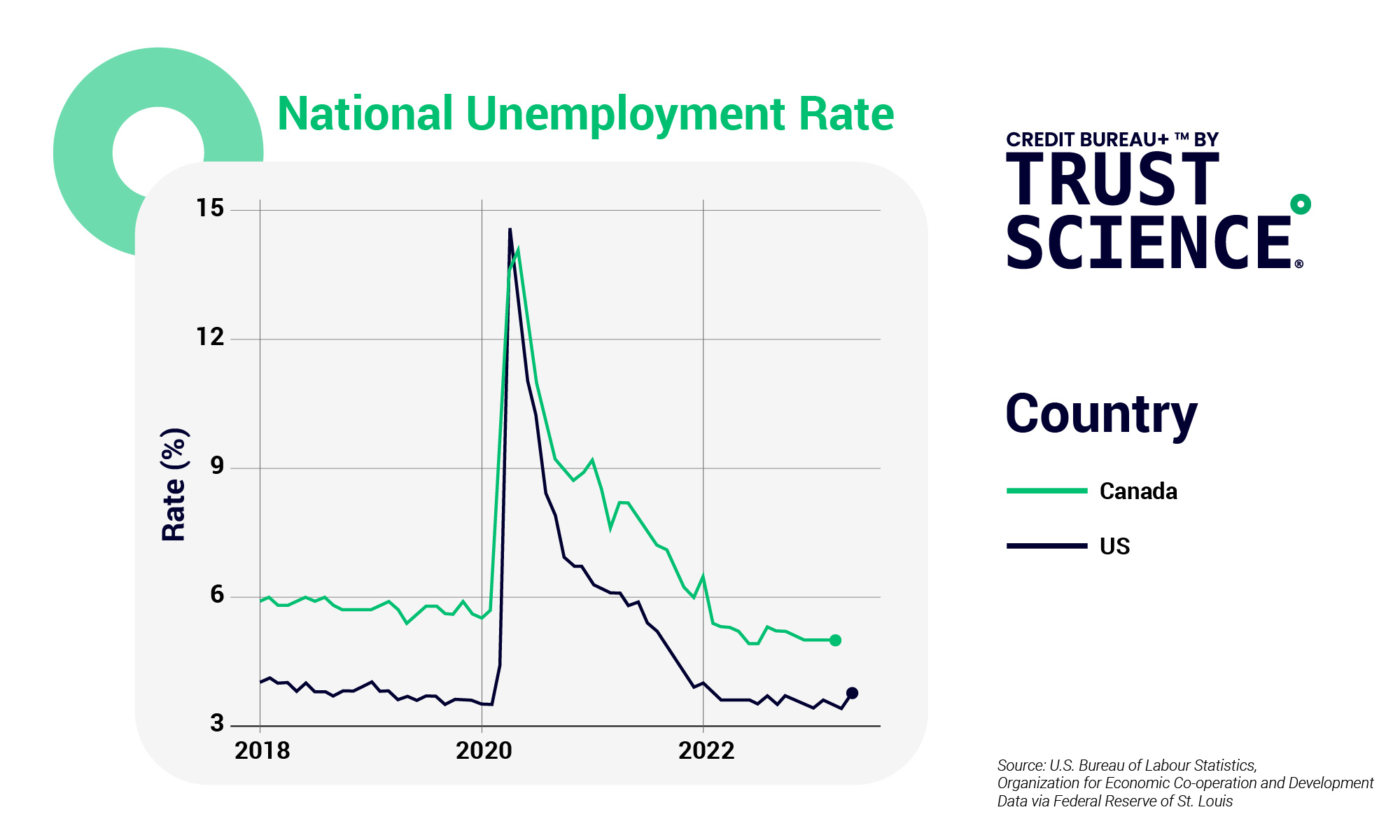

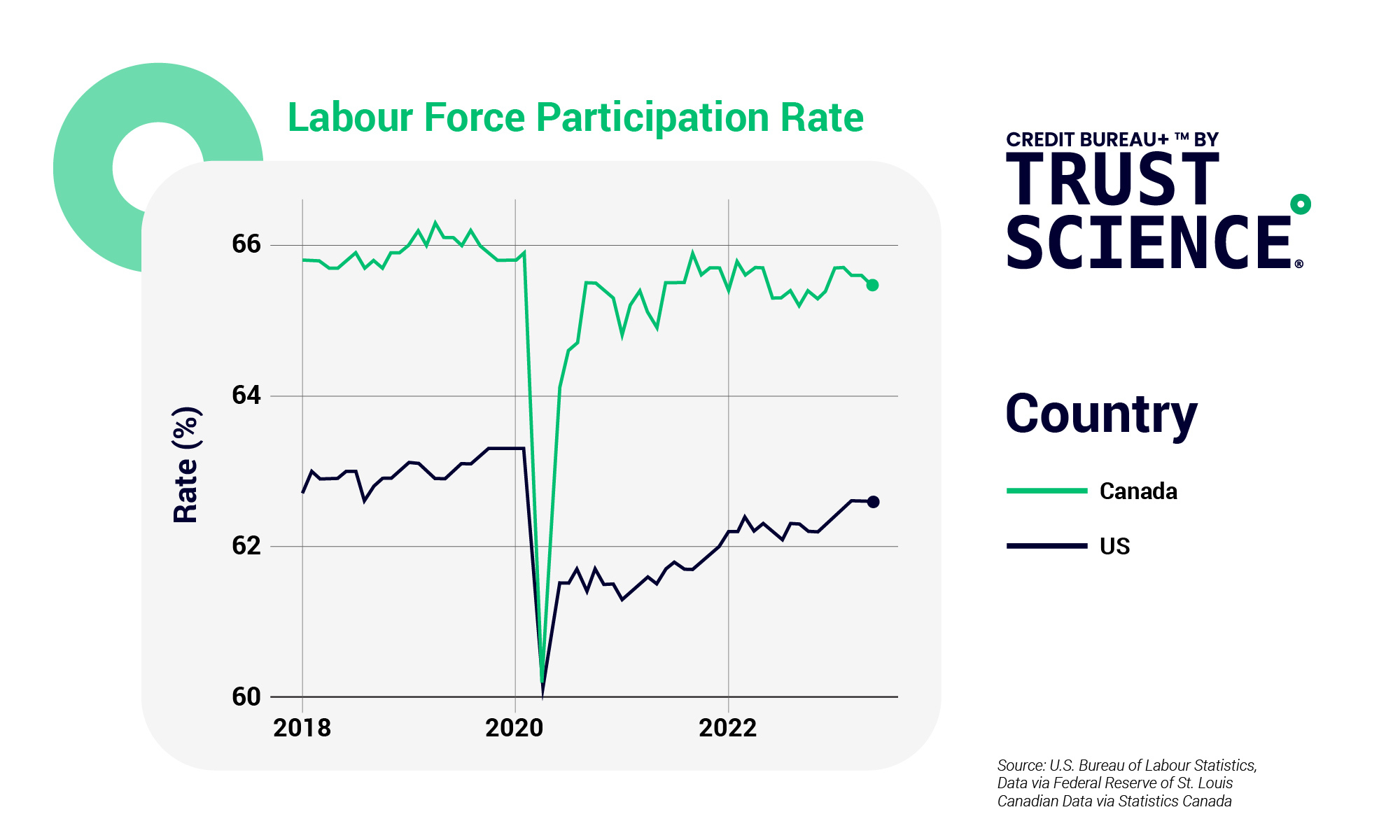

As bankruptcies have risen, and lending standards have tightened, many have expected the labour market to follow suit and finally falter alongside other key economic indicators. Despite this economic upheaval and pessimism, In the first quarter of 2023, both the United States and Canada continue to maintain their respective unemployment rates at or near pre-pandemic levels. This stability comes as a result of robust consumer spending and increased business investments, which have worked together since the reopening of the economy to sustain unemployment levels at 3.4% in the United States and 5.0% in Canada. In the face of surging inflation, where a higher percentage of disposable income has gone to purchase consumer goods, spending has remained steady helping to buoy a labour force still in recovery.

Lending in a Shaky Labour Market

Despite record-low unemployment, Analysts at J.P. Morgan have noted that subprime ABS (asset-backed security) deals have underperformed. Their subprime auto loan ABS study revealed higher delinquency and default rates in 2022 vintage deals compared to previous vintages. This unexpected trend has puzzled some market participants, as underwriting standards have remained stringent and market fundamentals have remained strong. The study attributes this underperformance to the unique impact of the pandemic, including reduced spending opportunities leading to increased savings and government transfer payments that supported non-prime borrowers. These factors contributed to lower household debt levels and improved debt-servicing abilities. However, analysts caution that as the temporary effects dissipate, credit scores are expected to normalize, which could negatively impact the performance of existing ABS bonds. This analysis underscores the need for a comprehensive understanding of credit trends in ABS auto deals and the potential opportunities and risks they present.

Outlook

Looking forward, the outlook for unemployment is uncertain. Analysts have modeled several possible scenarios and their impacts on the lending market in the United States and Canada. In an immaculate disinflation scenario, the economy could slow down, but contract, with a peak unemployment rate of 4.1% in 2024. Lending standards have already tightened significantly, particularly affecting small businesses with fewer than 250 workers, which account for a large portion of job openings. Alternatively, as rates increase, it is possible that the economy essentially stalls out, entering a ‘slowcession’, while the unemployment rate peaks at 5.3% in 2024. Facing high prices, consumer spending would eventually begin to sputter, and business investment would weaken, impacting the credit and lending market. In a deeper, longer recession scenario, the economy would experience a slow-moving train wreck, with growth stalling and contracting, while unemployment peaks at 5.8%, and credit conditions tighten further, affecting consumer and business borrowing. Faced with multiple scenarios, the future of credit in the current labour market is dubious. The tightening of lending standards and economic slowdown across scenarios pose challenges for both borrowers seeking credit, and lenders looking to increase originations. It will become more important than ever for lenders to make sure they are exploring all possible solutions to stay ahead of the whims of an uncertain market.