Building off of last week’s topic, CPI and general affordability, this week we’re discussing trends and implications of revolving credit liabilities and credit cards.

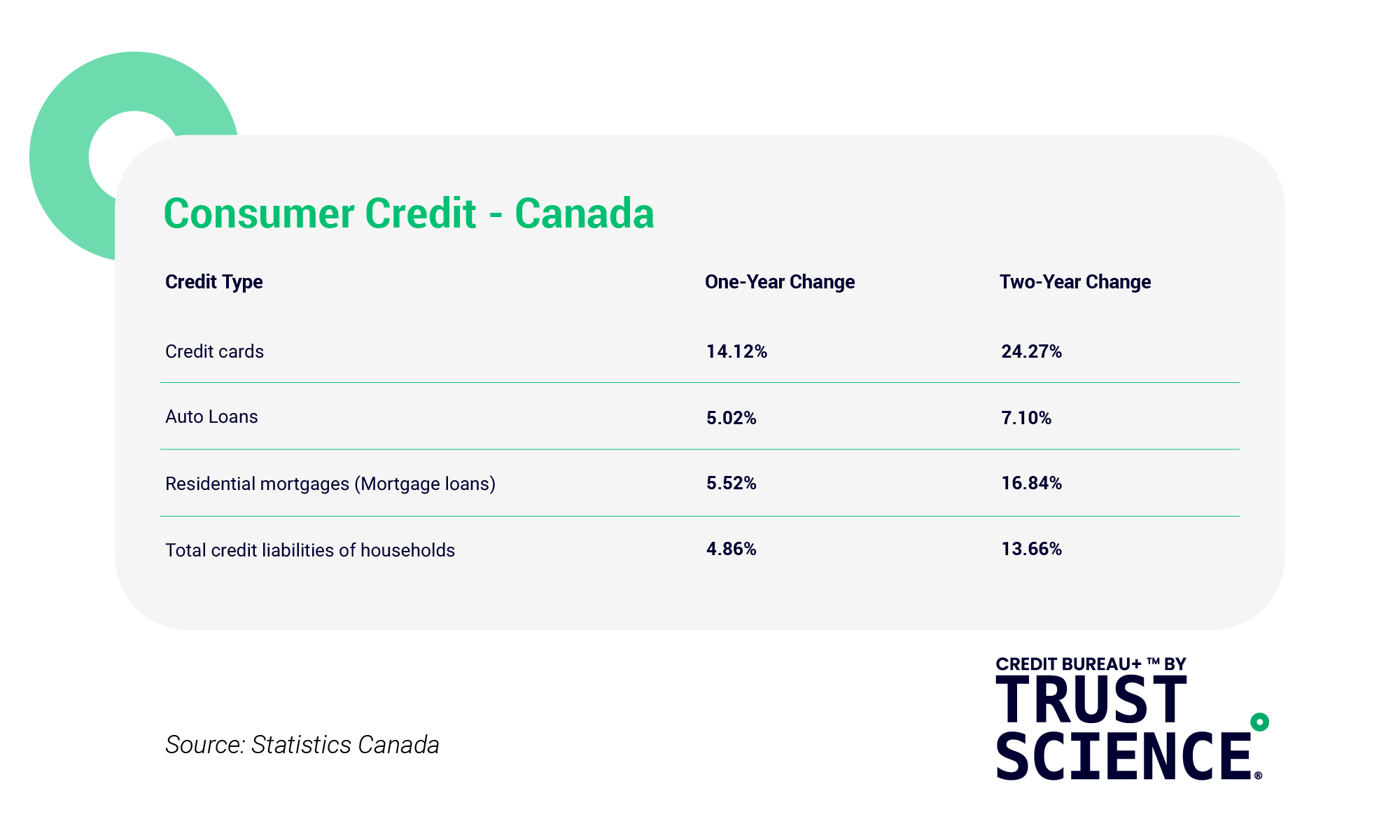

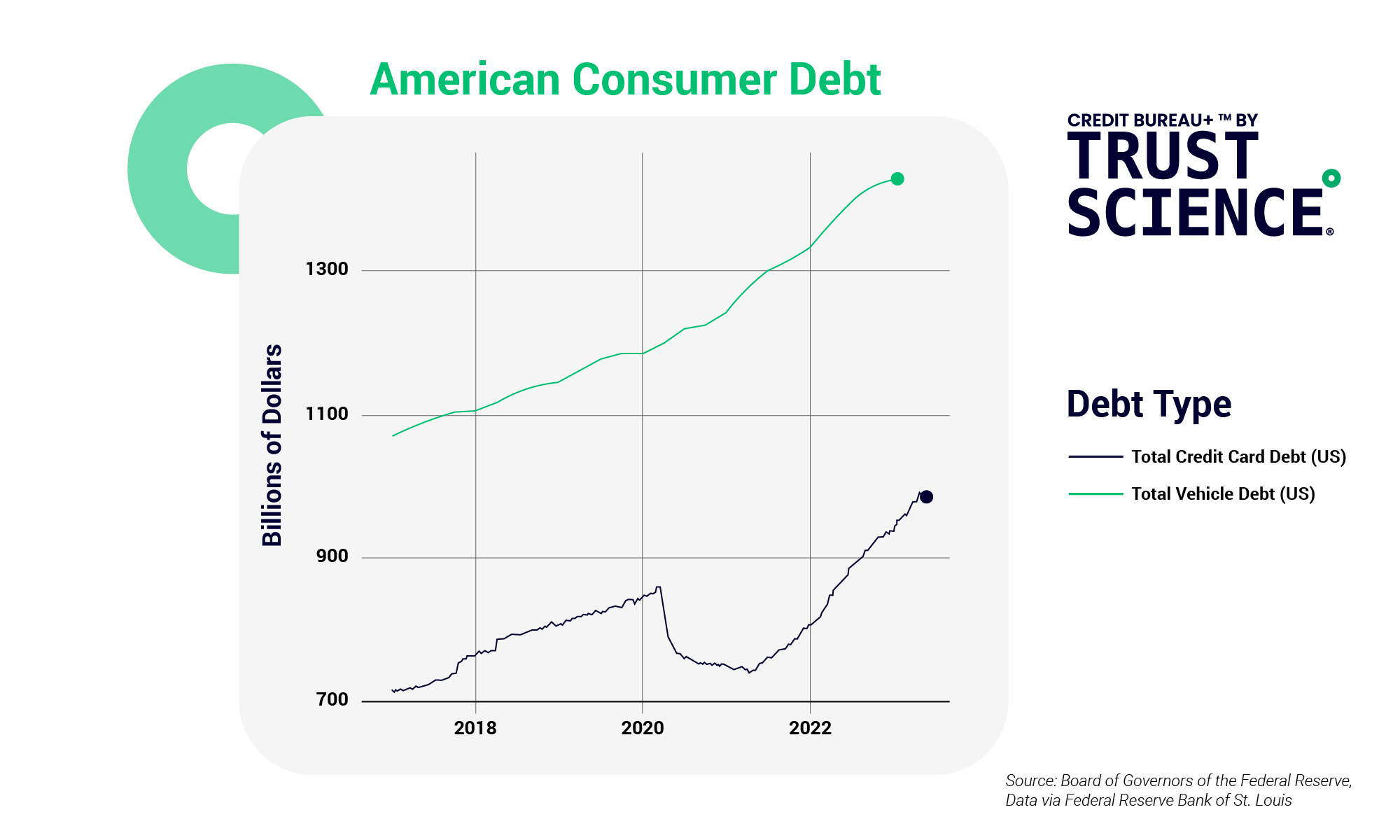

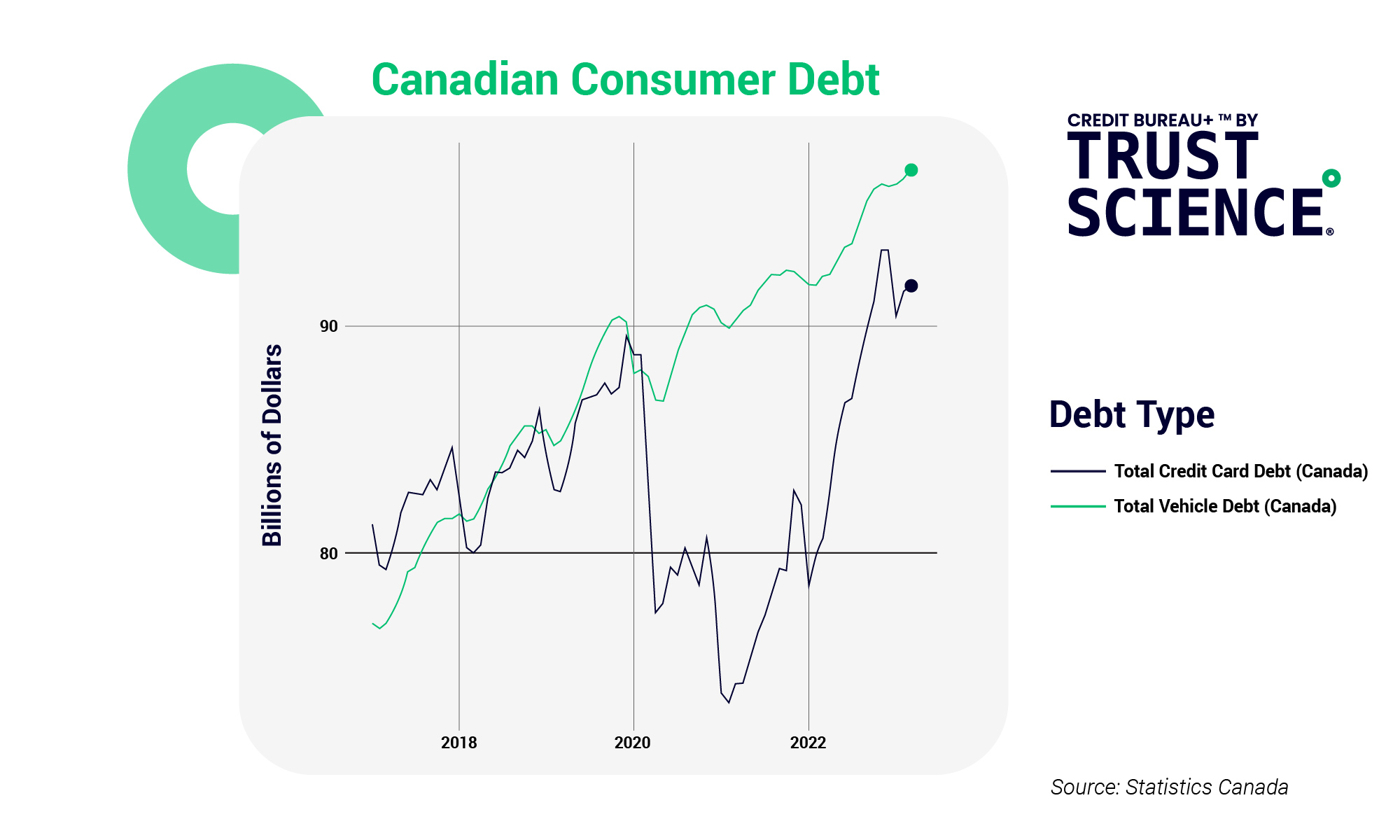

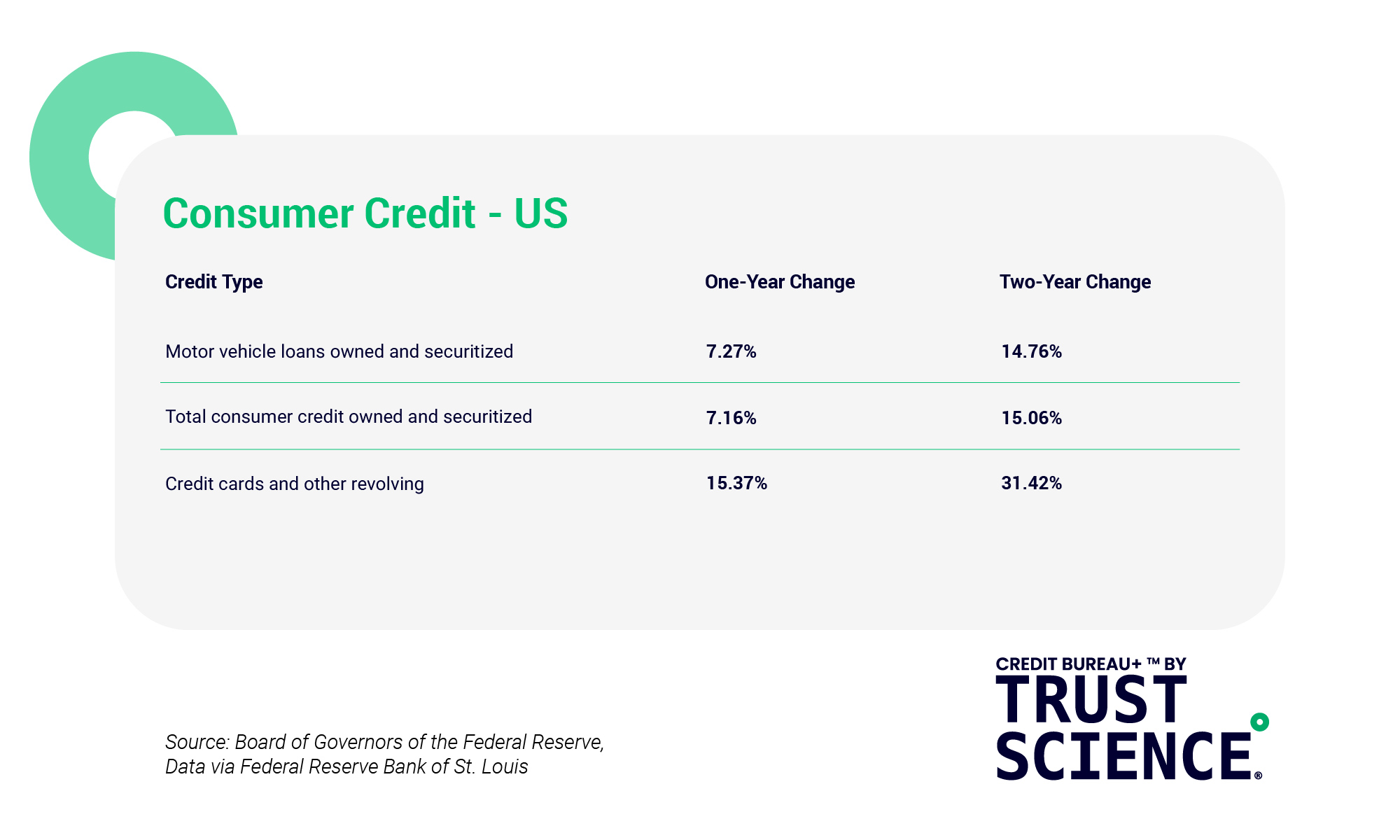

After a brief period in the first year of the pandemic in 2020 and early 2021, many components of consumer credit have seen significant increases in both the US and Canada. The below tables highlight one and two-year changes of select consumer credit types, for periods ending Q1 2023.

While it should be acknowledged that consumer debts in 2020 were heavily influenced by a multitude of factors including reductions in personal spending and increases in government financial support, these sizable shifts still paint a stark picture when comparing the financial position of North American consumers today, to two years ago. For reference, consumer credit card and revolving credit liabilities are still 14.0% higher than their 2020 pre-pandemic high in the US.

Increasing costs of living, and high benchmark interest rates are significant contributors to these increases in consumer credit. Consumers are increasingly reliant on credit cards and unsecured personal loans to make up household budget shortfalls, with higher interest rates making this behaviour more costly. These factors build an environment where consumers are at a higher risk of becoming unable to keep up with daily expenditures and debt servicing costs, forcing additional borrowing and increasing insolvency risk.

These trends of increased reliance on credit cards hold true in the subprime lending space, where consumers are more likely to be reliant on credit to pay for necessities. Throughout 2022, a Transunion report found that average bankcard account balances trended upward, citing inflationary pressures. Subprime borrowers saw the largest growth at 19%, followed by near-prime borrowers, at 13.8%.

Delinquencies

Credit card delinquencies in the US have already steadily increased throughout 2022 and 2023, with 2023 Q1 figures approaching pre-pandemic levels at 2.43%, from 1.67% in Q1 2022. Specifically looking at 90+ day delinquencies in Q1 2023, subprime borrower delinquencies increased to 12.42%, representing a 31.6% increase YoY, while all other risk tiers remained comparatively flat. Morningstar’s 2022 Q4 report suggests that Canadian credit card delinquencies are also trending up slightly, with 30+ day delinquencies increasing to 1.47% in December 2022 up from 1.38% in the prior year. 2020 Q1 (pre-pandemic) credit delinquencies in the US and Canada were 2.69% and 2.36%, respectively.

Outlook

Looking forward to Q2 2023, we anticipate credit card and other short-term personal credit liabilities to increase in the subprime space, albeit at a slower rate when compared to previous periods. Relative to last year, lenders have tightened criteria for subprime consumers, and as was highlighted in last week’s CPI post, the affordability of many consumer necessities has improved YoY, tempering demand on the consumer side. Despite signs of improving affordability, we still expect subprime delinquencies in both the US and Canada to increase, as consumers continue to grapple with notably high existing credit liabilities, increased borrowing costs, and inflation levels that are still well above the central bank’s two percent target.

In the current high-volatility environment, it’s imperative that lenders take advantage of additional types of data in order to evaluate which consumers should get credit. Ultimately as lending requirements tighten and defaults increase, it is becoming increasingly important to use all available tools including explainable AI and dynamic Machine Learning models to stay on the cutting edge of the lending landscape.