Though the direct impact of the COVID-19 pandemic waned significantly in the spring of 2022 for many in North America, macroeconomic changes brought upon by the pandemic and associated government policies have continued to impact daily consumer life. While some factors appear to be returning (and sometimes progressing beyond) pre-pandemic level, other factors have not.

As trends and customer characteristics continually evolve within the lending industry, drawing connections to broader macroeconomic trends can serve as a tool to demystify components of these changes. Over the next month, we will be releasing weekly posts highlighting the trends, sentiment and drivers behind a specific economic indicator that we view as crucial to the current health of the subprime lending space, as well as brief commentary on the direction we expect the indicator to follow going forward.

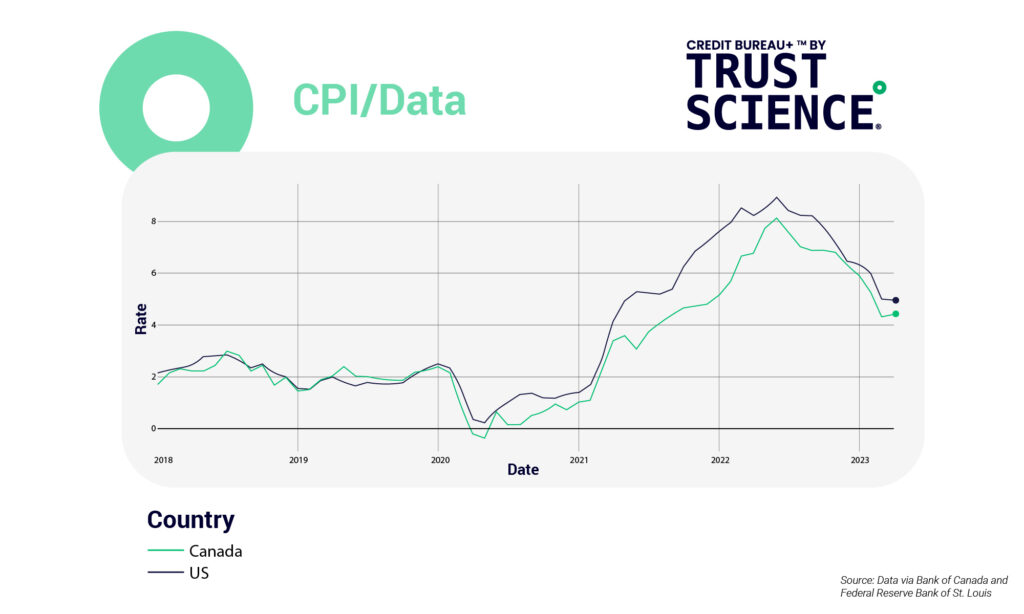

Inflation

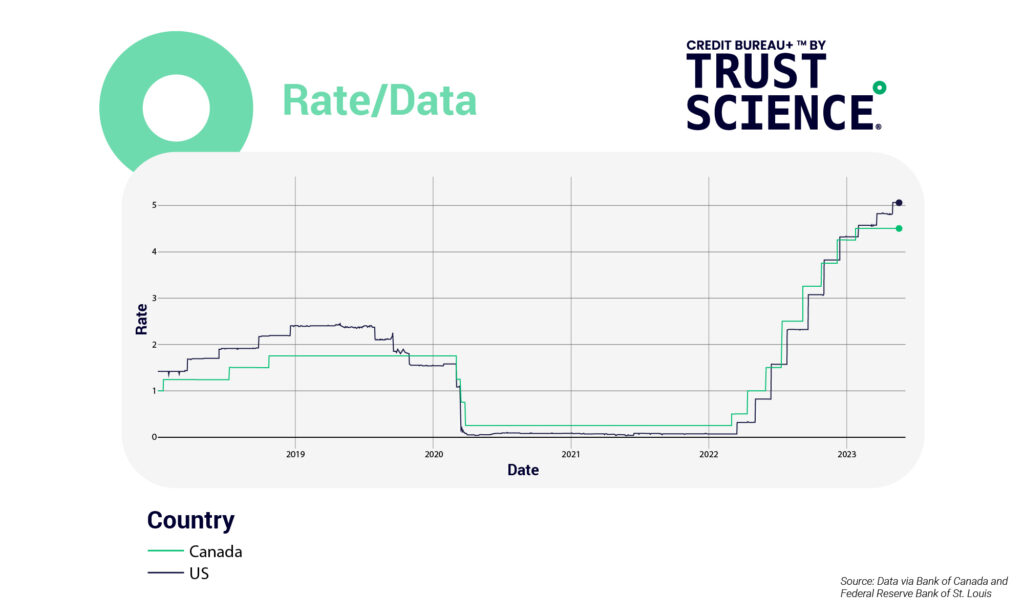

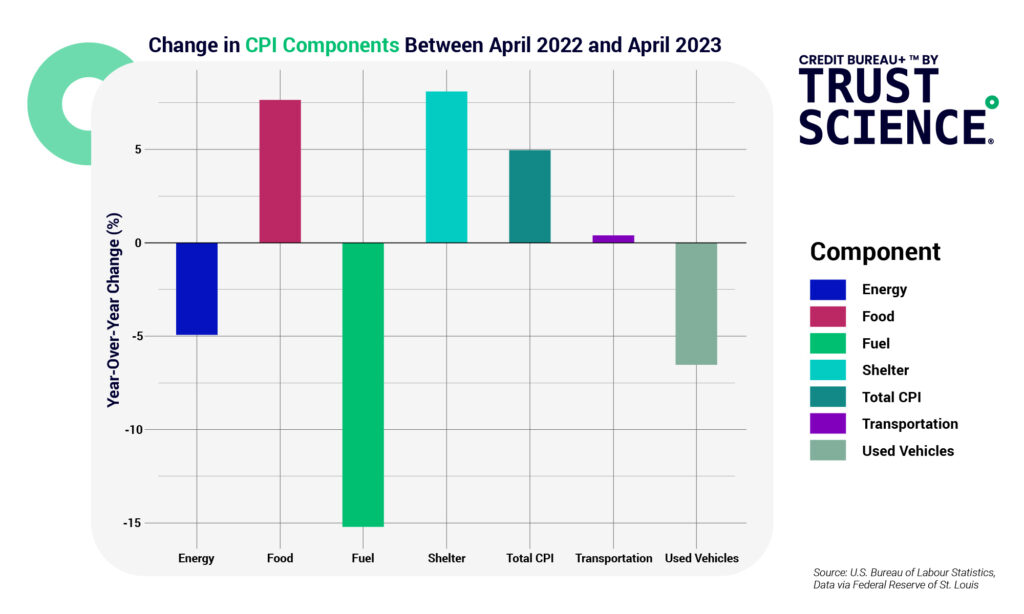

In April, inflation in the United States was lower than expected, despite a 0.4% increase, reaching a 4.9% annual rate. The rise in inflation was driven by higher prices for shelter, used vehicles, and gas, while fuel oil, new vehicles, and food prices declined. However, in Canada, inflation exceeded expectations, with the consumer price index rising 4.4% compared to the previous year. Although core measures of inflation continued to ease, the challenges in bringing inflation back to the target indicate a complex path ahead. This may lead to a continued hawkish stance and further rate increases. While the financial markets responded positively to the US inflation news, with increased futures and decreased Treasury yields, there is still concern as inflation remains above the Federal Reserve’s 2% target benchmark, highlighting the uncertain outlook for the economy.

In the face of elevated inflation, central banks have raised rates in an effort to curb spending and growth. Of all affected by these rate hikes the hardest hit have been near-prime and sub-prime borrowers. As rates have soared, climbing monthly payments have effectively squeezed this class of borrowers out of the new vehicle market. According to Kelley Blue Book parent company Cox Automotive, In 2018, subprime buyers made up more than 14% of new-vehicle sales, while deep subprime buyers were close to 10% of the market. This year, as interest rates have risen, subprime buyers account for roughly 6% of new-vehicle sales while deep subprime is less than 2%. Consequently, automakers have shifted their focus towards high-end vehicles exceeding $60,000, leaving buyers with limited credit options behind. In search of relief, many are turning to the used car market, where recent drops in wholesale prices provide a glimmer of hope. However, long-term prospects remain uncertain, with analysts predicting that inflated used car prices will persist due to a scarcity of supply stemming from pandemic-related factory shutdowns.

Housing Accessibility at New Lows for Subprime Borrowers

As the largest component of the CPI, the cost shelter has increased nearly 7% year-over-year. According to the Federal Reserve Board’s Senior Loan Officer Opinion Survey , lending standards for residential real estate (RRE) and commercial real estate (CRE) loans have also tightened as rising interest rates have driven mortgage rates up, particularly for subprime borrowers. Despite housing starts decreasing 22% YOY in the US and 3% in Canada, demand for RRE and CRE loans weakened across all categories including subprime. The net share of banks reporting tighter lending standards for subprime loans rose from 14.3% to 33.3%. Additionally, banks reported tightened terms for CRE loans, and weaker demand for construction and land development loans, multifamily property loans, and nonfarm nonresidential property loans. This tightening of lending standards will further price subprime and near-prime borrowers out of the market as housing affordability reaches its lowest ebb in decades.

Outlook

Looking forward, the Fed will continue to raise interest rates to combat record-high inflation aiming to bring it down to 2%. However, achieving this target without a recession may be challenging. If a recession does occur, job loss and increased unemployment could lead to higher delinquency rates on auto loans, particularly among subprime borrowers. Rising credit card balances coupled with higher interest rates may make it more difficult for borrowers to stay current on their payments and in general, a high interest rate environment is more damaging for subprime borrowers already paying high rates. Indeed, despite lower-than-expected inflation, it may prove to get worse for our economy before it gets better.