Rating Agency 2.0™

Don’t judge a loan book by its cover. Uncover its value with Rating Agency 2.0™

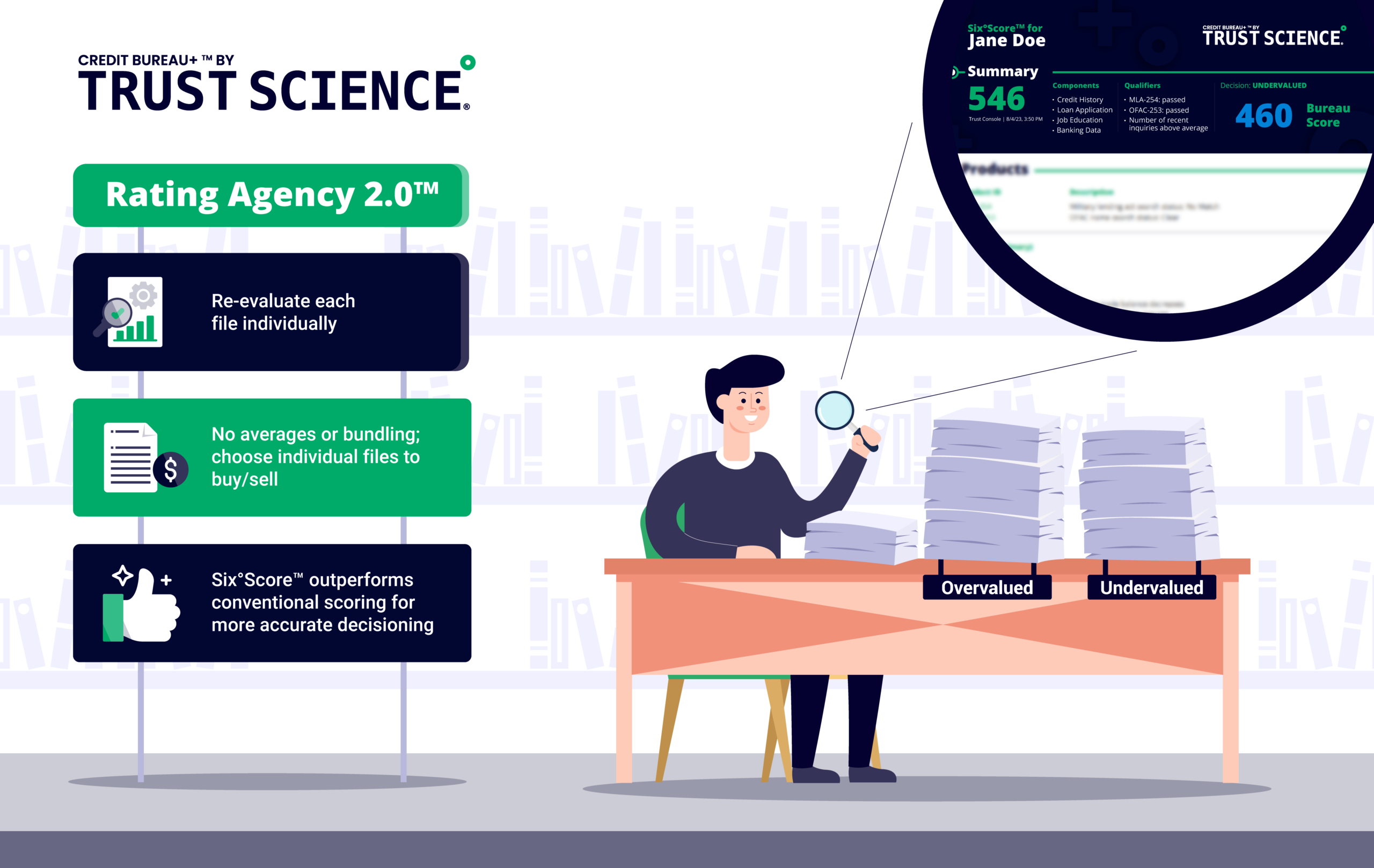

ACCOUNT BY ACCOUNT ANALYSIS

Empowering Asset Light Loan Originators

In today’s fiercely competitive lending landscape, Six°Score™ is revolutionizing the assessment of borrower creditworthiness for asset light loan originators. Our approach goes beyond traditional scores, providing a more comprehensive evaluation that uncovers hidden opportunities for confident investment decisions.

When a borrower’s Six°Score™ surpasses a conventional score, asset light loan originators can rest assured that the deal is undervalued and worth holding onto with confidence.

On the other hand, if a borrower’s Six°Score™ falls short of a conventional score, it indicates the deal is overvalued. But don’t worry, with our analysis, asset light loan originators can negotiate and find the right selling strategy for maximum returns.

GAINING AN EDGE IN THE ABS INDUSTRY

Uncovering Profitable Opportunities and Undervalued Tranches

Identifying undervalued tranches presents a golden opportunity for buyers to achieve maximum returns while minimizing risk.

For buyers, we acknowledge the need for selective evaluation, choosing the most valuable assets, and also avoiding overvalued files. Our platform enables you to review individual loans file-by-file, giving you the power to choose the best opportunities that align with your investment objectives. Uncovering undervalued portfolios presents a golden opportunity for buyers to optimize returns while mitigating the risk of default.

REVOLUTIONIZING LOAN EVALUATION

Game-Changing Scoring Models

Beat the conventional scores and find the over and undervalued loans to optimize your securitization negotiations.

Six°Score™ is Trust Science’s flagship probability of default (“PD”) score, leveraging thousands of data points from conventional, alternative, and proprietary sources. This powerful, explainable Al and ML platform helps you harness volatility and accurately assess your borrowers.

CONFIDENT DECISION-MAKING

Augmenting Conventional Approaches

At Trust Science, we understand the importance of building trust and credibility in the financial industry. That’s why we emphasize that our solutions, such as Six°Score™, are designed to augment existing scoring methods offered by conventional bureaus.

While we recognize that it may not be practical to immediately replace conventional scoring methods, our goal is to provide asset light loan originators and buyers with a powerful, data-driven alternative to enhance their decision-making process.

ACCOUNT BY ACCOUNT ANALYSIS

Empowering Asset Light Loan Originators

In today’s fiercely competitive lending landscape, Six°Score™ is revolutionizing the assessment of borrower creditworthiness for asset light loan originators. Our approach goes beyond traditional scores, providing a more comprehensive evaluation that uncovers hidden opportunities for confident investment decisions.

When a borrower’s Six°Score™ surpasses a conventional score, asset light loan originators can rest assured that the deal is undervalued and worth holding onto with confidence.

On the other hand, if a borrower’s Six°Score™ falls short of a conventional score, it indicates the deal is overvalued. But don’t worry, with our analysis, asset light loan originators can negotiate and find the right selling strategy for maximum returns.

GAINING AN EDGE IN THE ABS INDUSTRY

Uncovering Profitable Opportunities and Undervalued Tranches

Identifying undervalued tranches presents a golden opportunity for buyers to achieve maximum returns while minimizing risk.

For buyers, we acknowledge the need for selective evaluation, choosing the most valuable assets, and also avoiding overvalued files. Our platform enables you to review individual loans file-by-file, giving you the power to choose the best opportunities that align with your investment objectives. Uncovering undervalued portfolios presents a golden opportunity for buyers to optimize returns while mitigating the risk of default.

REVOLUTIONIZING LOAN EVALUATION

Game-Changing Scoring Models

Beat the conventional scores and find the over and undervalued loans to optimize your securitization negotiations.

Six°Score™ is Trust Science’s flagship probability of default (“PD”) score, leveraging thousands of data points from conventional, alternative, and proprietary sources. This powerful, explainable Al and ML platform helps you harness volatility and accurately assess your borrowers.

CONFIDENT DECISION-MAKING

Augmenting Conventional Approaches

At Trust Science, we understand the importance of building trust and credibility in the financial industry. That’s why we emphasize that our solutions, such as Six°Score™, are designed to augment existing scoring methods offered by conventional bureaus.

While we recognize that it may not be practical to immediately replace conventional scoring methods, our goal is to provide asset light loan originators and buyers with a powerful, data-driven alternative to enhance their decision-making process.