Six°Score™

Roughly 1 in 5 Americans are Invisible Prime™ borrowers, unable to be assessed fairly and accurately by conventional credit scoring. Six°Score™ is Trust Science’s flagship credit probability of default score, leveraging thousands of data points from conventional, alternative, and proprietary sources on a powerful explainable Al and ML platform to help you harness volatility and stop missing creditworthy borrowers.

Transforming the Credit Industry

The Six°Score™ Difference

With vertical-specific scoring models, Trust Science provides highly-specialized insights that allow lenders of all sizes to capitalize on our decades of risk expertise and receive powerful, compliant Six°Scores™. In all versions of the industry-leading Six°Score™, lenders get:

Learning System to Harness Volatility

Immediate Explainability

Advanced Logic to Automate Decisioning

Incorporate Deal Structures, Assets, and Co-Borrowers

EASY TO UNDERSTAND

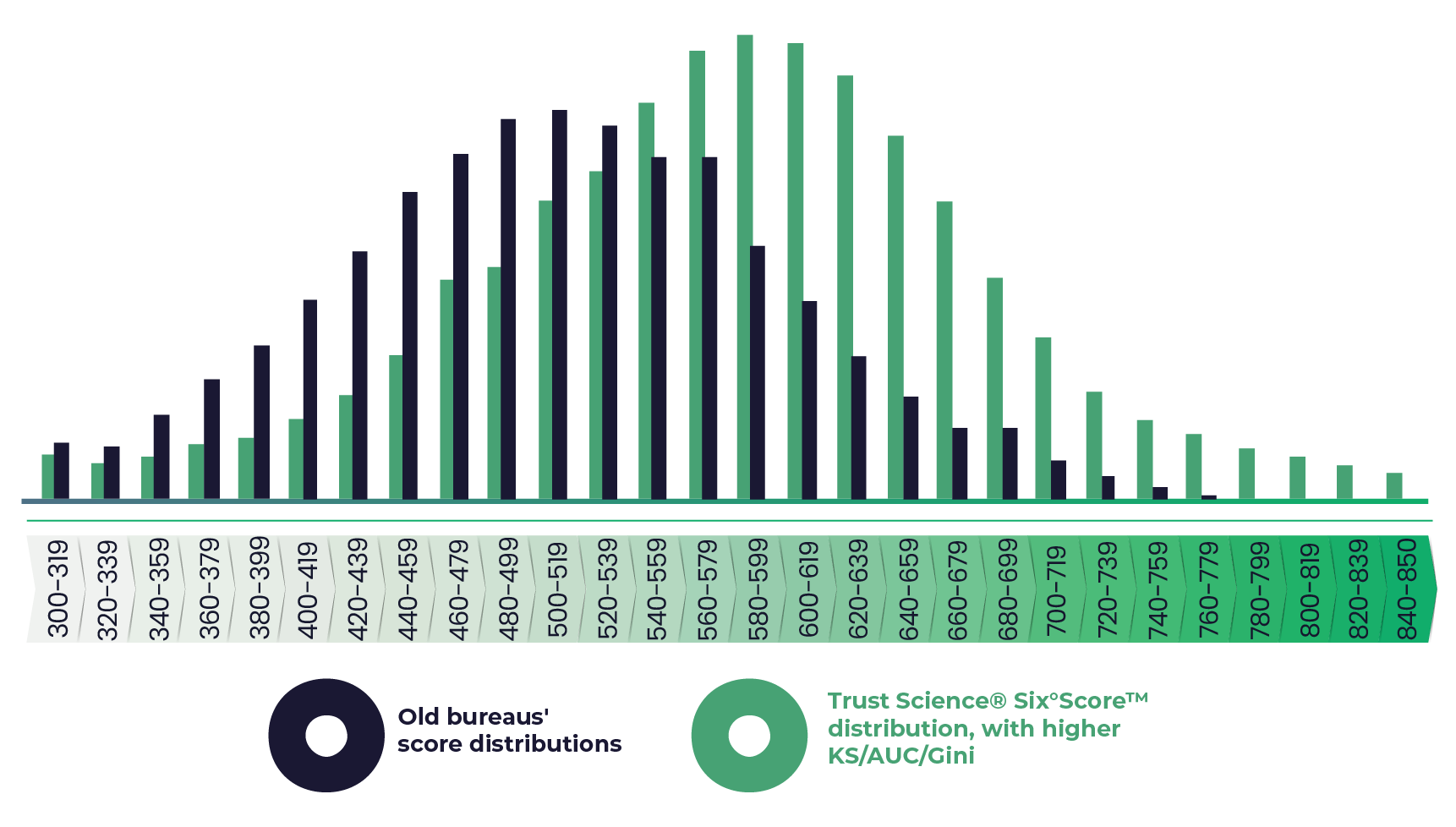

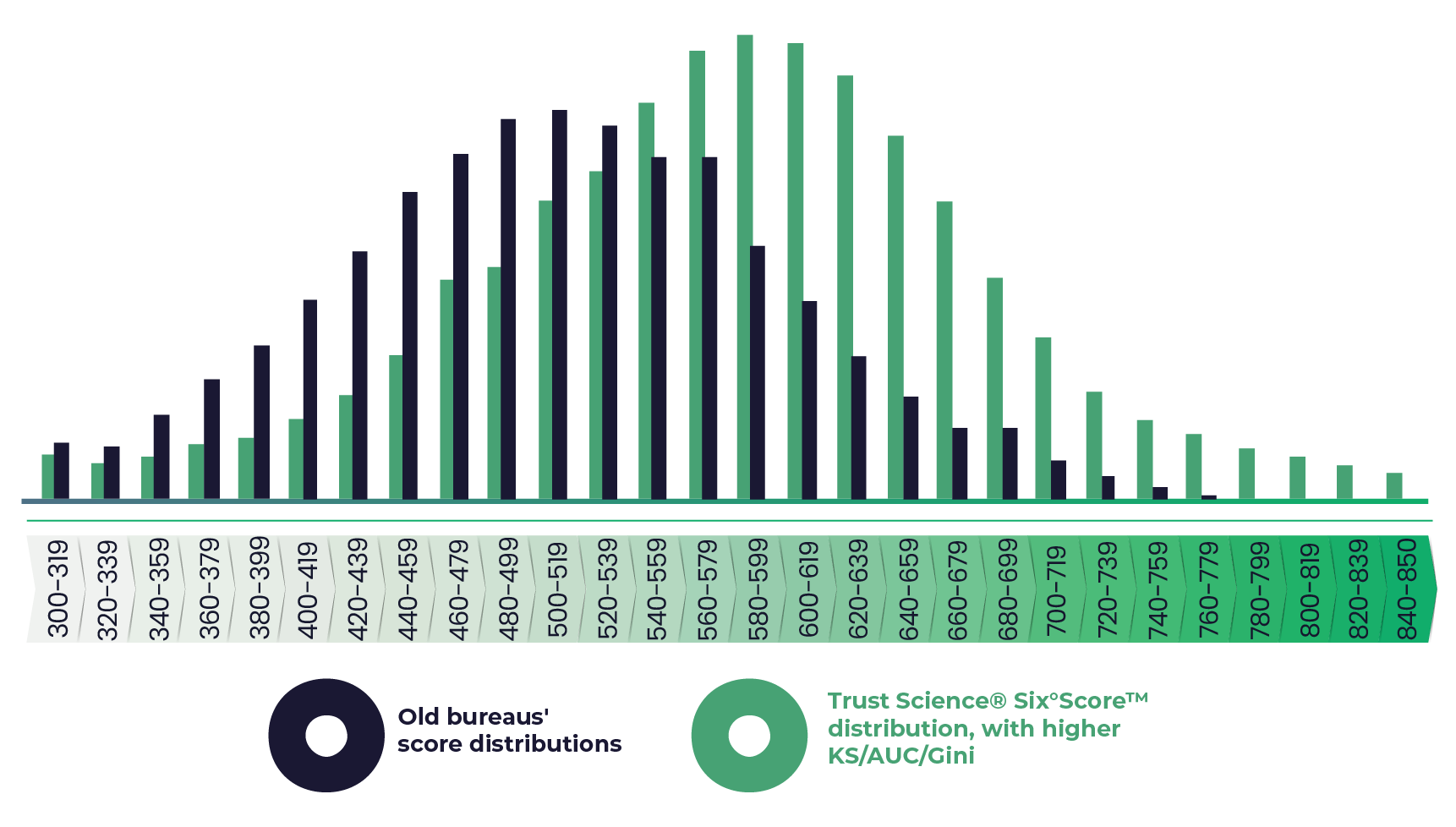

Explainable Scoring

At Trust Science®, we created a platform that is easy to understand and integrate, that’s why our Six°Score™ models provide credit scores in the traditional 300-850 range. Our scores are intuitive and feature a wide range of insights and ECOA compliant reason codes to ensure you and your customers understand exactly how a score was provided. Additionally, our scoring models can be customizable and adaptable to your specific credit scoring needs!

EASY TO UNDERSTAND

Explainable Scoring

At Trust Science®, we created a platform that is easy to understand and integrate, that’s why our Six°Score™ models provide credit scores in the traditional 300-850 range. Our scores are intuitive and feature a wide range of insights and ECOA compliant reason codes to ensure you and your customers understand exactly how a score was provided. Additionally, our scoring models can be customizable and adaptable to your specific credit scoring needs!

THE KEY TO ACCURATE SCORING

Superior Data

To build fully customizable machine learning models, Credit Bureau+™ by Trust Science® uses a comprehensive set of data sources including:

- Traditional credit bureau data

- Alternative data

- Proprietary data

Six°Score™ helps you better understand a borrower’s probability of default using an easy-to-integrate platform.

THE KEY TO ACCURATE SCORING

Superior Data

To build fully customizable machine learning models, Trust Science® uses a comprehensive set of data sources including:

- Traditional credit bureau data

- Alternative data

- Proprietary data

Six°Score™ helps you better understand a borrower’s probability of default using an easy-to-integrate platform.

TAILORED TO THE CUSTOMER

Recommended Loan Amounts

Optimize your strategy and risk tolerance with our Recommended Loan Amount (RLA) and Recommended Payment Amount (RPA) for payday and installment loans.

TAILORED TO THE CUSTOMER

Recommended Loan Amounts

Optimize your strategy and risk tolerance with our Recommended Loan Amount (RLA) and Recommended Payment Amount (RPA) for payday and installment loans.

NOT ONE SIZE FITS ALL

Powerful, Dynamic Scoring Models

Credit Bureau+™ by Trust Science® has the following standard models available for quick implementation that leverage our consortium database built on years of industry-specific expertise:

- Canadian Installment

- American Installment

- American Auto

- Canadian Auto

In addition to the standard models, we are able to curate a model specific to your lending strategy and performance data. Go a step further, and have Trust Science® API enabled directly into your LOS/LMS workflow, significantly reducing manual entries.

NOT ONE SIZE FITS ALL

Powerful, Dynamic Scoring Models

Trust Science® has the following standard models available for quick implementation that leverage our consortium database built on years of industry-specific expertise:

- Canadian Installment

- American Installment

- American Auto

- Canadian Auto

Six°Score™ helps you better understand a borrower’s probability of default using an easy-to-integrate platform.

Who Do We Help?

Direct & Indirect Auto Lenders

It’s not simply just the borrower risk – it’s about the vehicle, the deal structure, and the effectiveness of your collections process/skip-tracing.

Installment and Single Repayment Lenders

Our data constellation gives our clients the ability to gain unparalleled insights into an applicant’s background, leading to increased originations and decreased defaults.